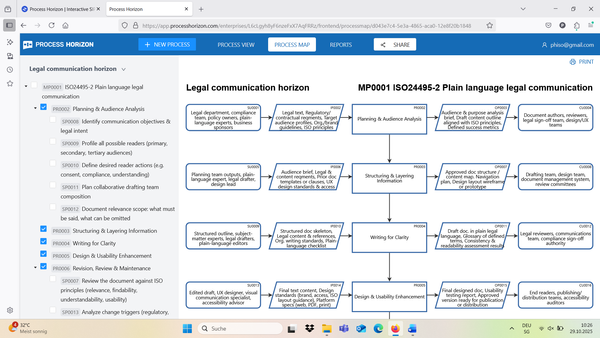

If your organization produces legal‐type documents (contracts, terms, forms, rights/obligations notices) and you want to ensure they are readable, accessible & understandable by non-legal audiences, then ISO 24495-2 is highly relevant.

* Legal services & law firms: drafting contracts, terms of service, legal notices, rights/obligations documents

* Government / public