VAT taxation for AI products & services

Implementing a VAT system for AI products and services requires a balance between promoting innovation and ensuring fair taxation. To this end thresholds or exemptions for small businesses or low-value transactions should be defined.

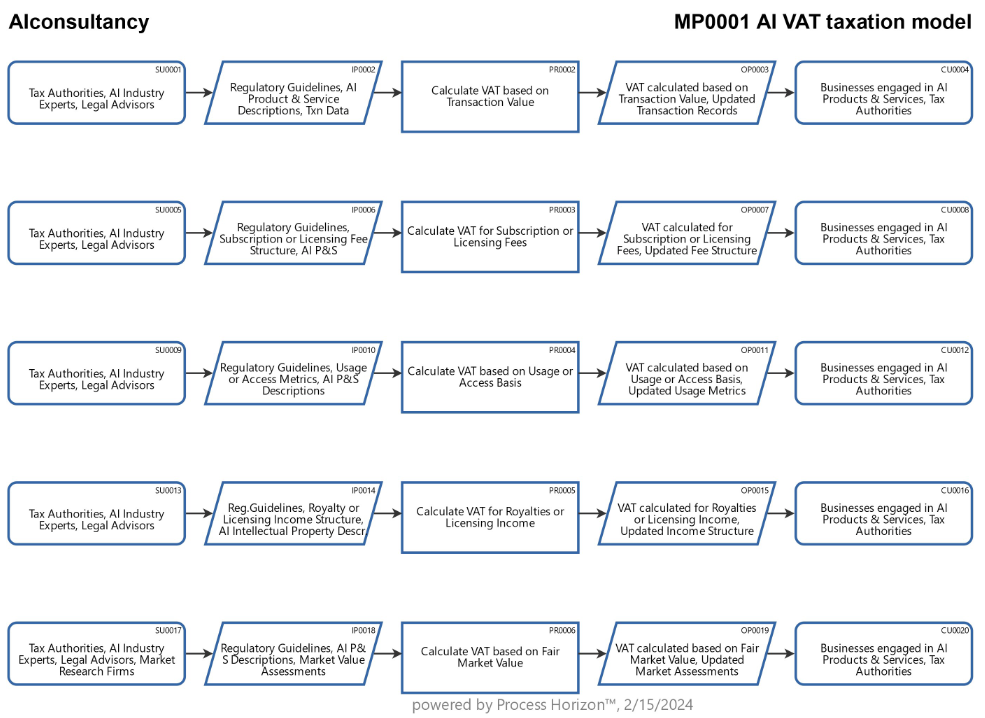

This VAT process framework outlines some conceivable VAT tax basis options for AI products and services. Depending on the nature of the AI product (physical device or software) and service, different tax bases may be applied. A physical AI device might have a different basis than a cloud-based AI service.

1. VAT Calculation based on Transaction Value

Identify Transaction Components:

- Review AI transactions to identify components contributing to the transaction value

- Clarify what constitutes the transaction value for VAT calculation

Transaction Value Calculation:

- Assess and calculate VAT based on the transaction value

- Ensure compliance with regulatory guidelines for determining transaction value

2. VAT Calculation for Subscription or Licensing Fees

Subscription or Licensing Fee Assessment:

- Review subscription or licensing fee structures for AI products and services

- Identify how these fees contribute to the VAT tax basis

VAT Application to Subscription Fees:

- Apply VAT to subscription or licensing fees based on regulatory guidelines

- Ensure consistency in the application of VAT to recurring charges

3. VAT Calculation based on Usage or Access Basis

Define Usage or Access Metrics:

- Establish criteria for linking VAT to the actual usage or access of AI capabilities

- Determine how usage metrics contribute to the VAT tax basis

VAT Application to Usage Basis:

- Apply VAT based on the defined metrics for AI usage or access

- Ensure accurate measurement and reporting of usage

4. VAT Calculation for Royalties or Licensing Income

Define Intellectual Property Components:

- Identify AI products or services involving intellectual property

- Define how royalties or licensing income contribute to the VAT tax basis

VAT Application to Royalties:

- Apply VAT to royalties or licensing income based on regulatory guidelines

- Ensure alignment with the unique aspects of patented algorithms or proprietary models

5. VAT Calculation based on Fair Market Value

Fair Market Value Determination:

- Establish criteria for determining the fair market value of AI products and services

- Incorporate market assessments and benchmarks

VAT Application to Fair Market Value:

- Apply VAT based on the determined fair market value

- Ensure compliance with regulatory guidelines for market-based taxation

Using the following link you can access this sandbox process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/1TYsvWAx9ufY3CcYEjeYpv23/frontend