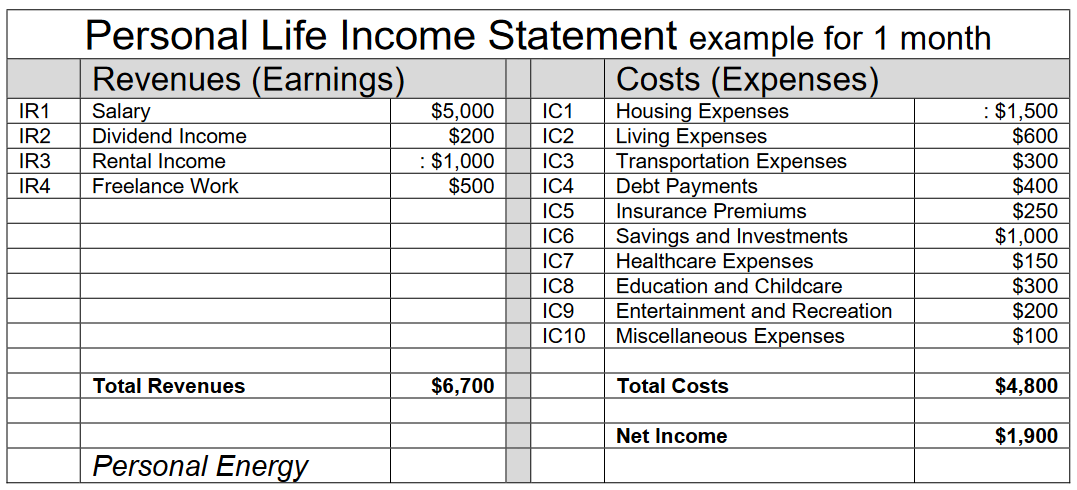

Personal Life Income Statement

A personal life income statement, also known as a personal income and expense statement, summarizes an individual's financial performance over a specific period (usually monthly or annually). It includes revenues (income) and costs (expenses).

Revenues (Income)

1. Salary and Wages

- Gross salary from employment

- Bonuses

- Overtime pay

- Commissions

2. Investment Income

- Interest income (savings accounts, CDs)

- Dividend income (stocks, mutual funds)

- Capital gains (profits from the sale of investments)

3. Rental Income

- Rent received from properties owned

4. Business Income

- Earnings from self-employment

- Profits from a side business or freelance work

5. Other Income

- Alimony or child support received

- Social Security benefits

- Pension or retirement income

- Government benefits (unemployment, disability)

- Gifts or inheritances

- Miscellaneous income (lottery winnings, royalties)

Costs (Expenses)

1. Housing Expenses

- Rent or mortgage payments

- Property taxes

- Home insurance

- Maintenance and repairs

- Utilities (electricity, water, gas, oil)

- Homeowners association fees

2. Living Expenses

- Groceries and household supplies

- Dining out

- Clothing and personal care

3. Transportation Expenses

- Car payments

- Auto insurance

- Fuel

- Maintenance and repairs

- Public transportation costs

4. Debt Payments

- Credit card payments

- Personal loan repayments

- Student loan payments

5. Insurance Premiums

- Health insurance

- Life insurance

- Disability insurance

- Property & Household insurance

- Car insurance

6. Savings and Investments

- Contributions to savings accounts

- Retirement account contributions

- Investment account contributions

7. Healthcare Expenses

- Medical bills

- Prescription medications

- Health-related expenses (dental, vision)

8. Education and Childcare

- Tuition fees

- School supplies

- Childcare costs

- Extracurricular activities

9. Entertainment and Recreation

- Hobbies

- Vacations

- Subscriptions (streaming services, magazines)

10. Miscellaneous Expenses

- Gifts and donations

- Pet care

- Legal fees

This personal income statement helps to track where money is coming from and how it is being spent, providing a clear picture of an individual's financial performance over a specific period.