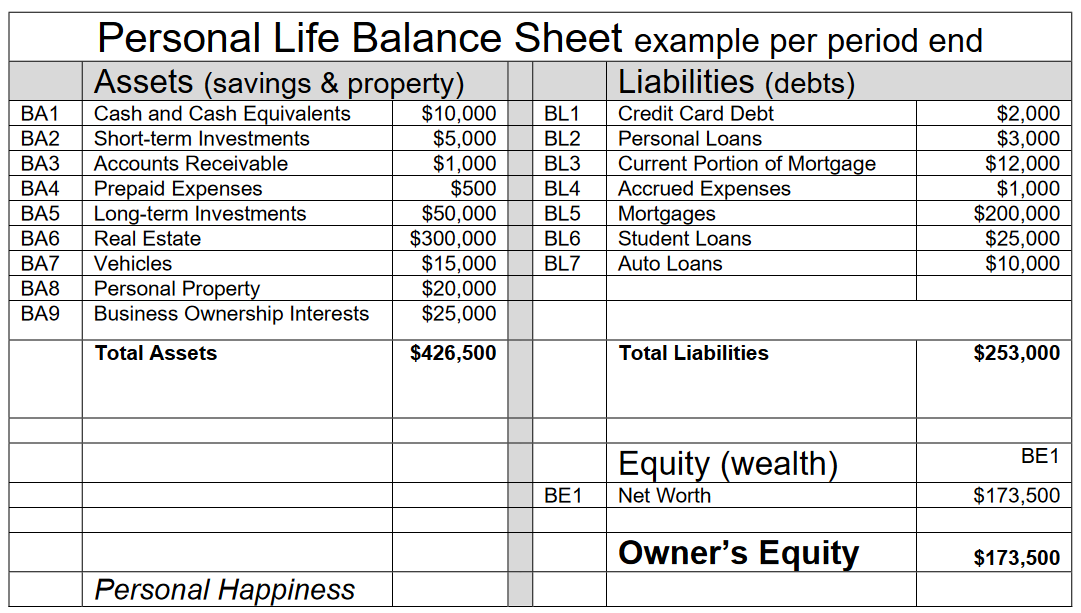

Personal Life Balance Sheet

A personal life balance sheet is a financial statement that summarizes an individual's financial position at a given point in time. It includes three main components: assets, liabilities and equity.

Assets (savings & property)

1. Current Assets

- Cash and Cash Equivalents:

- Cash on hand

- Checking accounts

- Savings accounts

- Short-term Investments

- Certificates of Deposit (CDs)

- Treasury bills

- Marketable securities

- Accounts Receivable

- Money owed to you by others

- Prepaid Expenses

- Prepaid rent

- Prepaid insurance

2. Long-term Investments

- Stocks

- Bonds

- Mutual funds

- Retirement accounts

3. Fixed Assets

- Real estate (home, rental properties)

- Vehicles

- Personal property (furniture, electronics, jewelry)

- Land

4. Other Assets

- Business ownership interests

- Intellectual property (patents, copyrights)

- Life insurance with cash value

Liabilities (debts)

1. Current Liabilities

- Short-term Debt:

- Credit card debt

- Personal loans

- Medical bills

- Current Portion of Long-term Debt:

- The portion of mortgages, auto loans or other long-term debt due within a year

- Accrued Expenses:

- Unpaid utility bills

- Taxes owed

2. Long-term Liabilities

- Mortgages:

- Home mortgage

- Second mortgage or home equity loans

- Student Loans:

- Remaining balances on educational loans

- Auto Loans:

- Loans for vehicle purchases

- Other Long-term Debt:

- Business loans

- Personal loans from family or friends

Equity (wealth)

1. Net Worth

- Total Assets minus Total Liabilities

- This represents the individual's equity or ownership interest in their personal financial situation.

2. Owner’s Equity

- Retained earnings (savings and investments accumulated over time)

- Additional paid-in capital (e.g., inheritances, gifts)

By categorizing your finances this way, you can clearly see your financial health and identify areas where you might need to improve, such as paying down debt or increasing savings.

Wealth management is a comprehensive service focused on taking a holistic look at a client's financial picture, including services such as investment management, financial planning, tax planning and estate planning.