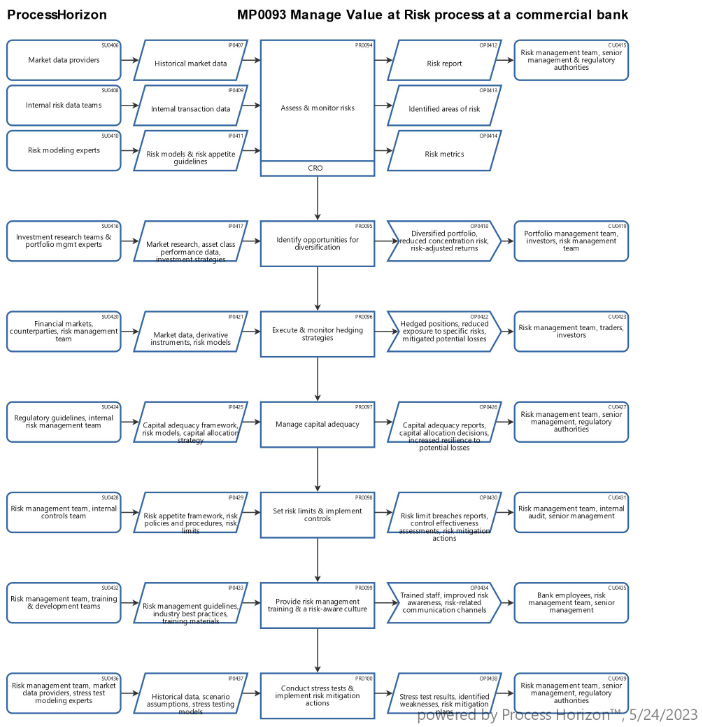

Manage VaR process at a commercial bank

Value at Risk (VaR) is a measure used to estimate the potential loss a bank or financial institution may face within a specific time period, typically under normal market conditions and a given confidence level. Reducing VaR requires implementing risk management practices aimed at mitigating potential losses. Here are several ways in which a bank can work to reduce its VaR:

- Risk Assessment and Monitoring: Regular and thorough risk assessment is crucial in identifying potential areas of risk and taking appropriate measures to mitigate them. Banks should employ risk management frameworks that include ongoing monitoring and evaluation of risk exposures, allowing for timely identification of potential threats and the implementation of risk mitigation strategies.

- Diversification: By diversifying its portfolio across different asset classes, sectors, and geographic regions, a bank can reduce concentration risk. Diversification helps to spread the risk, so that losses from one investment or sector can be offset by gains in others, reducing the overall VaR.

- Risk Hedging: Banks can use financial derivatives, such as options, futures, and swaps, to hedge against specific risks. Hedging allows banks to reduce the potential losses associated with adverse movements in interest rates, exchange rates, or commodity prices, among others.

- Capital Adequacy: Maintaining sufficient capital levels in accordance with regulatory requirements is essential. Higher levels of capital act as a buffer against potential losses and enhance a bank's ability to absorb unexpected shocks, reducing the potential VaR.

- Risk Limits and Controls: Implementing robust risk limits and controls helps to manage risk exposures within predefined boundaries. Banks should establish risk limits for various activities and ensure they are consistently monitored and enforced.

- Risk Education and Culture: Promoting a risk-aware culture throughout the organization is crucial. Banks should provide ongoing training and education to employees, fostering a strong understanding of risk management principles and best practices at all levels.

- Stress Testing: Banks can conduct stress tests to assess their vulnerability to adverse scenarios, such as economic downturns, market shocks, or extreme events. By simulating these stress scenarios, banks can identify areas of weakness and take preventive measures to reduce potential losses.

It's important to note that while these measures can help reduce VaR, they do not eliminate the possibility of losses entirely. Risk management is an ongoing process that requires continuous monitoring, adaptation, and response to changing market conditions and emerging risks.

Explore the smart ProcessHorizon web app for automated SIPOC process modeling > https://processhorizon.com