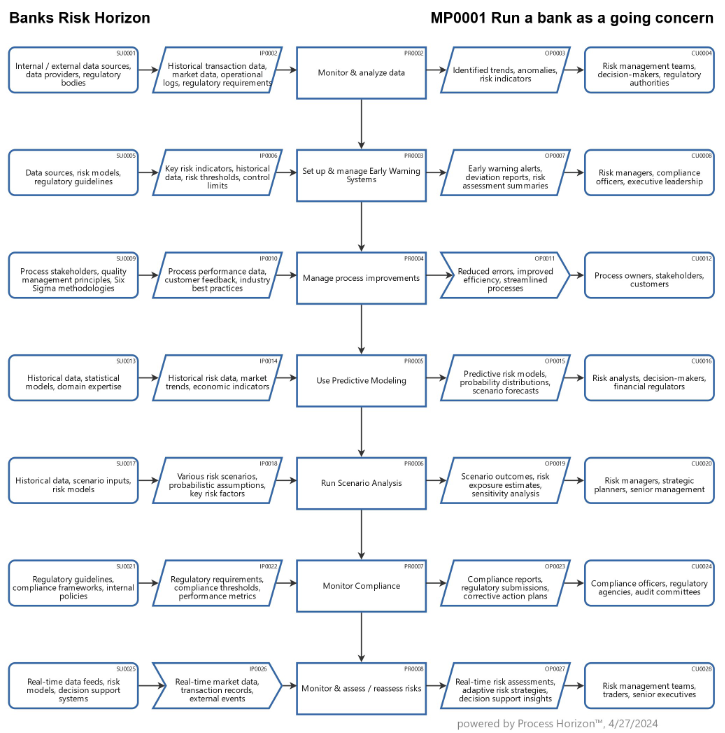

How to run a bank as a going concern ?

On top of a bank's holistic risk management as outlined in my SIPOC process map, several regulative measures could be implemented to help prevent future bank failures.

- Enhanced Capital Requirements: Regulators can mandate higher capital adequacy ratios for banks, ensuring they have sufficient capital buffers to absorb losses during periods of financial stress. This reduces the likelihood of insolvency and provides greater resilience to adverse economic conditions.

- Stress Testing: Implementing rigorous stress testing programs to assess a bank's ability to withstand severe economic downturns or specific risk scenarios. Stress tests help identify vulnerabilities and ensure banks have adequate risk management practices in place.

- Liquidity Requirements: Requiring banks to maintain sufficient liquidity buffers to meet short-term funding needs, reducing the risk of liquidity crises during times of market stress.

- Improved Risk Management Standards: Establishing and enforcing robust risk management standards, including guidelines for identifying, measuring and managing various types of risks such as credit, market, liquidity and operational risks.

- Enhanced Supervision and Oversight: Strengthening regulatory oversight and supervision of financial institutions to ensure compliance with regulatory requirements and to detect emerging risks early on.

- Resolution Frameworks: Developing effective resolution frameworks to facilitate the orderly wind-down or restructuring of failing banks while minimizing the impact on financial stability and the broader economy.

- Corporate Governance Reforms: Implementing reforms to enhance corporate governance practices within financial institutions, including greater board oversight, improved risk culture and alignment of executive compensation with risk management objectives.

- Transparency and Disclosure Requirements: Enhancing transparency and disclosure requirements to provide stakeholders with better information about a bank's risk profile, financial condition and governance practices.

- Counter-cyclical Measures: Implementing counter-cyclical measures such as adjusting capital requirements or loan-to-value ratios in response to changes in the economic cycle to prevent excessive risk-taking during periods of economic expansion.

- International Coordination: Enhancing international coordination and cooperation among regulators to address cross-border risks and ensure consistent implementation of regulatory standards across jurisdictions.

The recent instances of bank failures indicate potential inadequacies in risk management practices within financial institutions, particularly regarding the management of combined risks within a macroeconomic framework and raises concerns that bank management may be engaging in excessive risk-taking behaviors.

Using the following link you can access this sandbox process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/oSQz1mmPQmTLZqFLPHGrVuzs/frontend