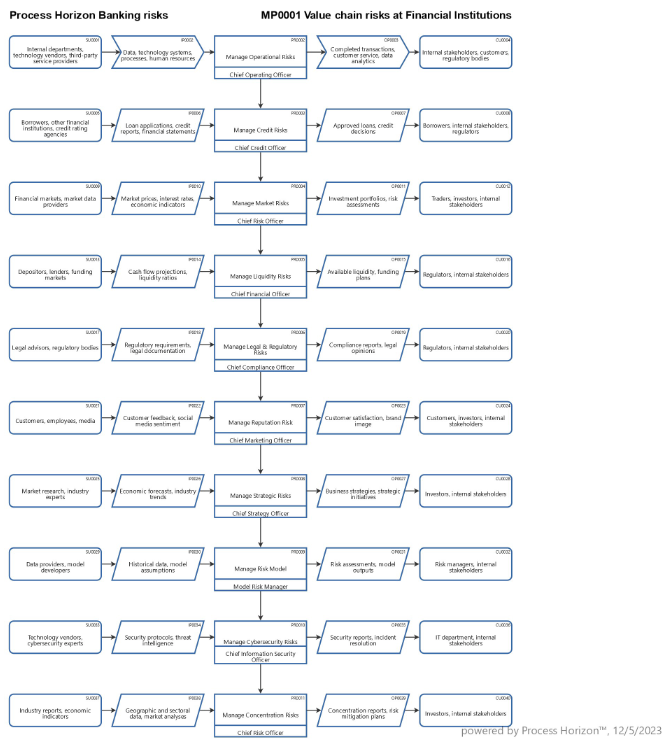

How to manage value chain risks at Financial Institutions ?

The value chain of a financial institution encompasses a series of activities and processes involved in delivering financial products and services to customers.

1. Operational Risks

- Internal Processes: Inefficiencies, errors, or breakdowns in internal processes, such as transaction processing could lead to operational failures.

- Technology Risks: Reliance on technology systems exposes financial institutions to the risk of cyberattacks, system failures or data breaches.

- Outsourcing Risks: If parts of the value chain are outsourced, the institution may face risks associated with the performance and reliability of third-party service providers.

2. Credit Risks

- Loan Portfolio: The creditworthiness of borrowers and the quality of the loan portfolio can pose risks, especially during economic downturns.

- Counterparty Risk: Exposure to the risk that counterparties, such as other financial institutions may fail to fulfill their financial obligations.

3. Market Risks

- Interest Rate Risk: Fluctuations in interest rates can impact the institution's profitability, particularly if there is a mismatch between interest-sensitive assets and liabilities.

- Market Price Risk: Holdings of financial instruments, such as securities may be subject to changes in market prices.

4. Liquidity Risk

- Funding Risks: Inability to meet short-term obligations due to insufficient liquidity or a sudden withdrawal of funds by depositors or lenders.

- Market Liquidity: Difficulty in selling financial instruments in the market without causing significant price changes.

5. Legal & Regulatory Risks

- Compliance Risks: Failure to comply with regulatory requirements and changes in legislation could lead to legal consequences and financial penalties.

- Litigation Risks: Legal actions against the institution, whether related to customer disputes, regulatory violations or other issues.

6. Reputation Risk

- Customer Relations: Dissatisfaction among customers due to poor service, perceived unfair practices or other issues can damage the institution's reputation.

- Social and Environmental Impact: Increasing awareness of social and environmental issues may expose financial institutions to reputation risk if their practices are perceived as detrimental.

7. Strategic Risks

- Business Model Risks: Changes in the economic environment or industry trends could impact the viability of the institution's business model.

- Strategic Planning: Inadequate strategic planning or execution may result in missed opportunities or failed initiatives.

8. Risk Model Risks

- Risk Models: Reliance on inaccurate or outdated risk models for decision-making may lead to misjudgments and unexpected losses.

- Assumption Risks: Assumptions underlying financial models may not hold true in changing economic conditions.

9. Cybersecurity Risk

- Data Security: Breaches in data security could expose sensitive customer information, leading to financial losses and reputational damage.

- Operational Disruption: Cyberattacks may disrupt critical systems, leading to operational downtime and financial losses.

10. Concentration Risks

- Geographic Concentration: Overreliance on a particular geographic region for business may expose the institution to regional economic risks.

- Sector Concentration: A heavy concentration of assets in a specific industry may amplify the impact of economic downturns in that sector.

Financial institutions need to proactively identify, assess and manage these hidden risks and exposures to ensure the resilience and sustainability of their value chain. Regular risk assessments, comprehensive stress testing and a robust risk management framework are essential components of mitigating these risks. Additionally, fostering a risk-aware culture within the organization is crucial for early detection and effective risk management.

Using the following link you can access this sandbox process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/rputvybFYUk5jLFnqSr19N6v/frontend