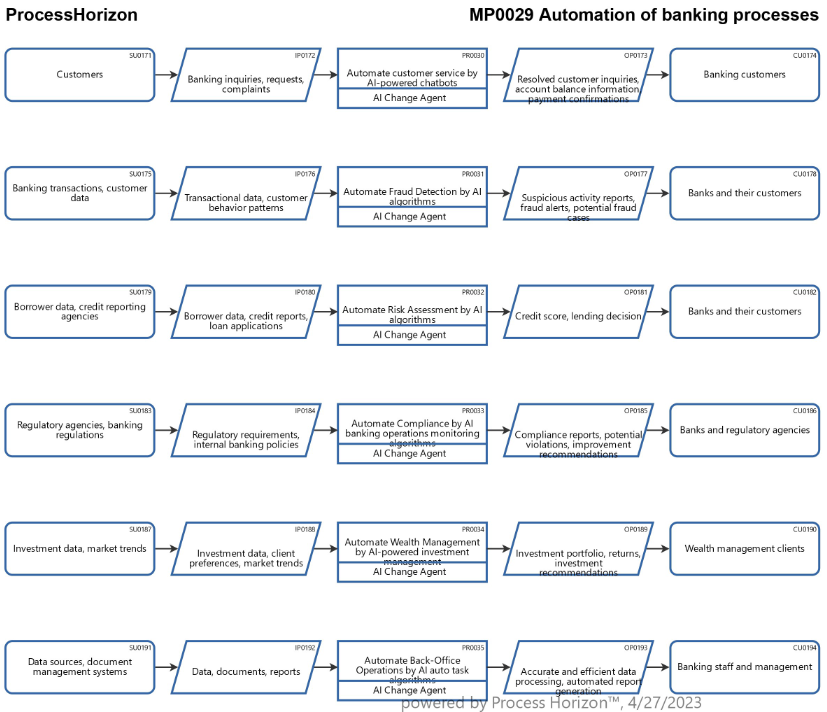

Conceivable automation of banking processes by AI

The process transformation involves the automation of digital banking services by AI algorithms. The use of AI in banking can improve efficiency, accuracy, and customer satisfaction while reducing costs and risks for financial institutions.

My question is who can drive this transformation from people dependent processes to consistent automated digital processes customized to the client profile and needs ?

What are the implications e.g. for the UBS - CS merger ?

I think it's vital to have a good understanding of the processes and tasks for an an evaluation of the automation potential.

The smart ProcessHorizon web app can provide a SIPOC process model with an auto generated Process map in minutes and a comprehensive hierarchical enterprise model within hours based on process manager input.

Supplier (Source) > Input > PROCESS > Output > Customer (Destination)

Using the automated SIPOC methodology in the ProcessHorizon web app, the process owners, i.e. the banking professionals like wealth & asset managers, etc. or subject matter experts like risk managers & compliance officers can iteratively document their best practice processes with no need for costly consultancy. It's sophisticated simplicity.

The benefits of the easy to understand SIPOC process modeling approach are ad-hoc process and busines insights as a prerequisite to leverage of your business model and respective processes.

Explore the interactive process modeling web app https://processhorizon.com