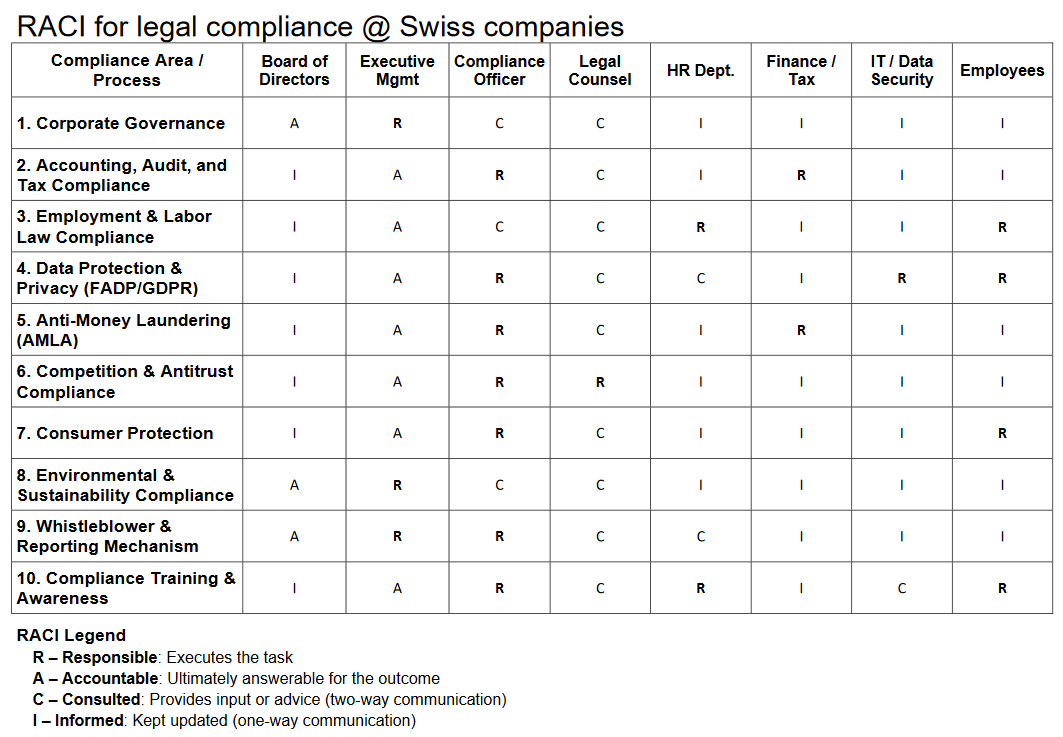

RACI for legal compliance @ Swiss companies

This RACI matrix assigns clear roles and responsibilities by identifying who is Responsible, Accountable, Consulted and Informed for each task or decision within a process. It can be used as part of your compliance governance framework to ensure your company systematically fulfills all legal obligations in Switzerland, reduces legal risk and maintains trust with stakeholders while supporting operational efficiency and governance.

Risk Prevention: Proactively identify and manage compliance risks (e.g. data breaches, tax fraud, etc.)

Transparency. Ensure internal and external visibility into compliance status

Accountability: Define clear roles and responsibilities for compliance tasks

Documentation: Create audit trails and legal evidence of due diligence

Efficiency: Automate and streamline compliance activities across departments

Adaptability: Respond quickly to changes in laws, especially in dynamic areas like AML or data protection

A structured legal compliance framework is essential for Swiss companies, particularly when expatriates hold executive or board positions such as members of the Board of Directors e.g. at big banks (like the collapsed Credit Suisse). These individuals may not be fully familiar with Swiss legal and regulatory requirements, which can lead to gaps in oversight and governance.

This challenge is not unique to Switzerland; it affects expatriates in senior roles across jurisdictions, underscoring the need for clear compliance processes to ensure accountability and alignment with local laws.

The main stakeholders involved or affected by a company's legal compliance are as follows:

Internal Stakeholders

Board of Directors: Ultimate oversight of legal risks and compliance strategy

Executive Management: Sets tone at the top and allocates resources for compliance

Compliance Officer: Designs, monitors, and enforces the compliance process

Legal Counsel: Interprets laws and provides guidance on compliance obligations

HR Department: Ensures labor law and data protection compliance

Finance & Tax Teams: Responsible for audit, accounting, and tax law compliance

IT/Data Security: Responsible for audit, accounting, and tax law compliance

Employees: Must follow internal policies and report breaches

External Stakeholders

Regulatory Authorities: e.g. FINMA, SECO, cantonal tax offices, Data Protection Office

Auditors: Assess legal and financial compliance

Shareholders/Investors: Expect legal risk to be controlled and disclosed

Clients/Customers: Rely on privacy, ethical treatment and lawful conduct

Suppliers/Partners: Must meet the company’s compliance standards

Whistleblowers/Ombuds: Report internal misconduct or non-compliance

Money Laundering Reporting Office SWI: Receives reports of suspicious financial activity (AML-related)