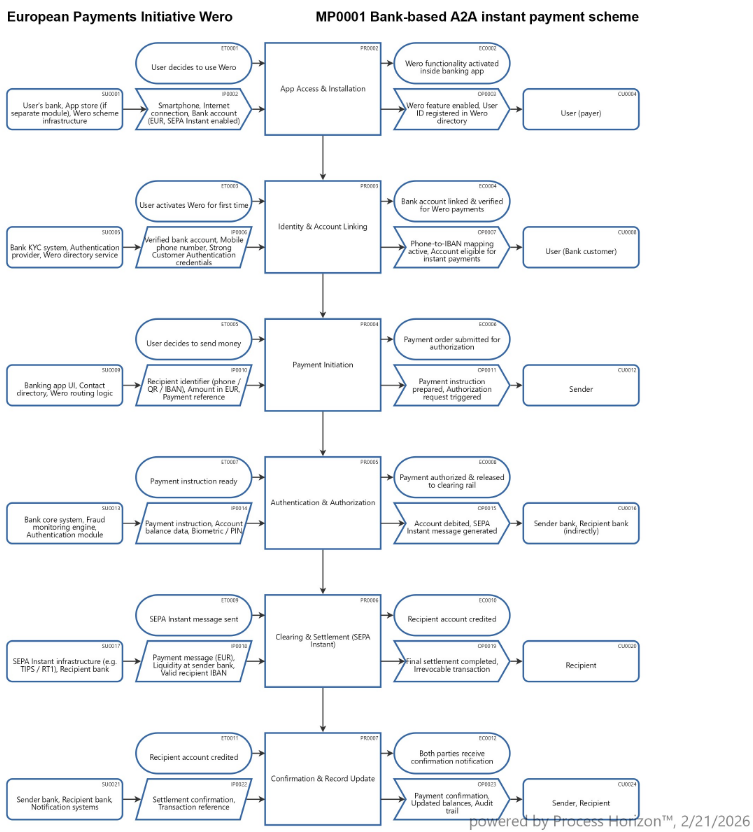

European Payments Initiative Wero

Wero is designed as an account-to-account (A2A) payment system that functions as a push model based on SEPA Instant Credit Transfer (SCT Inst). The payer actively pushes funds from their bank account via SEPA Instant.

Wero is a pay-now system, meaning that:

- Funds are debited immediately

- Payment is final once executed

- No deferred settlement like credit cards

However Funds remain in the user’s bank account until the moment of payment.

The smartphone functions as authentication interface, payment initiation device and directory lookup mechanism. It does not hold value.

P1. App Access & Installation

- User downloads or updates banking app

- User logs in

- User activates Wero feature

- Terms & conditions accepted

P2. Identity & Account Linking

- Bank verifies identity (KYC already completed)

- Phone number linked to IBAN

- Registration transmitted to Wero directory

- Confirmation received

P3. Payment Initiation

- User selects recipient

- App resolves recipient IBAN via Wero directory

- User enters amount

- User confirms intent

P4. Authentication & Authorization

- Strong Customer Authentication performed

- Fraud checks executed

- Balance verified

- Payment approved

P5. Clearing & Settlement (SEPA Instant)

- Clearing system validates message

- Interbank liquidity transferred

- Recipient bank receives funds

- Recipient account credited (≤10 seconds)

P6. Confirmation & Record Update

- Confirmation returned to sender bank

- Sender receives success notification

- Recipient notified of incoming funds

- Transaction stored in account history

Risk implications of 'Pay Now'

because settlement is instant and final:

User Risks

- Wrong recipient entry => irreversible transfer

- Fraud exposure if authentication compromised

- No chargeback mechanism like credit cards

System Risks

- Real-time fraud monitoring must operate in milliseconds

- Liquidity management for banks must be continuous

Using the following link you can access this sandbox SIPOC model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual AllinOne SIPOC map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/ogi21gq6SCVcZ4Mr7bYALrYF/frontend