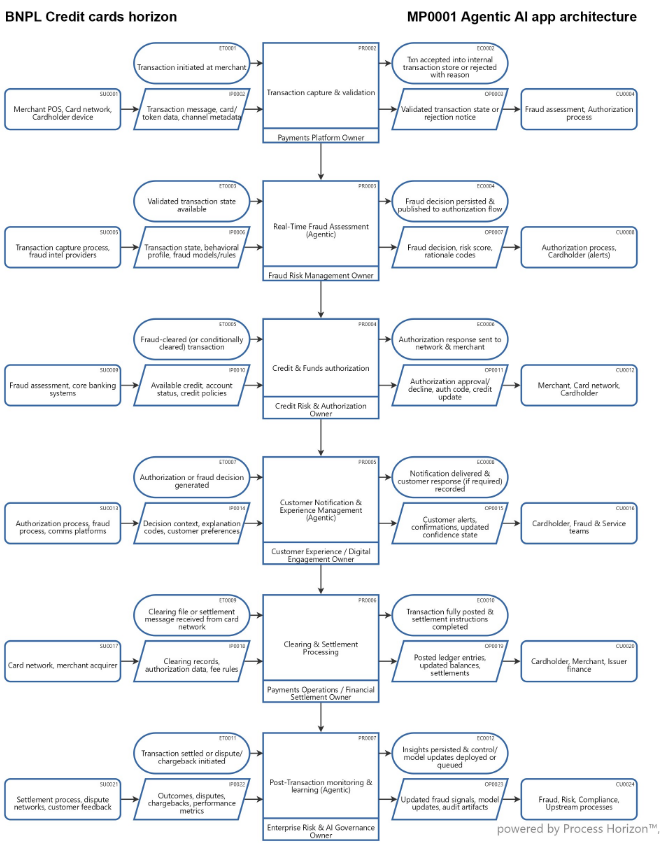

Buy Now, Pay Later Agentic AI app architecture

This is a value-stream-oriented SIPOC map for credit card transaction processing by an Agentic AI application.

Each SIPOC (Suppliers > Inputs >PROCESS >Outputs > Customers) decomposition represents a distinct, stakeholder visible process in the end-to-end transaction lifecycle:

1. Transaction capture & validation Validate, normalize & register transaction state

2. Real-Time Fraud Assessment (Agentic) Contextualize transaction & evaluate fraud risk

3. Credit & Funds Authorization Apply credit rules & reserve funds

4. Customer Notification & Experience Management (Agentic) Generate notifications & handle customer confirmation

5. Clearing & Settlement processing Match, reconcile & post settled transactions

6. Post-Transaction Monitoring & Learning (Agentic) Monitor, analyze, learn & adjust controls

SIPOC is a system-thinking methodology for AI systems and in particular for Agentic AI. In SIPOC data is state & process is state transition and that is exactly how AI systems operate at runtime. SIPOC is thus arguably the most effective way to conceive, design & implement Agentic AI apps.

Remember, if you cannot express an AI capability clearly in SIPOC,

you do not yet understand the system well enough to build it.

Using the following link you can access this sandbox SIPOC model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual AllinOne SIPOC map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/5KJvNXCEDCpRLKVeJRh5tX5p/frontend