AI-driven banking ecosystem

The key challenge for banking with Agentic AI is ensuring that autonomous decision-making systems act transparently, ethically, and in alignment with regulatory and risk-management frameworks in a highly complex and regulated environment.

The market risks of an AI-driven banking ecosystem include model-driven volatility, systemic errors from correlated AI behaviors, lack of transparency in automated decisions, and rapid amplification of market shocks.

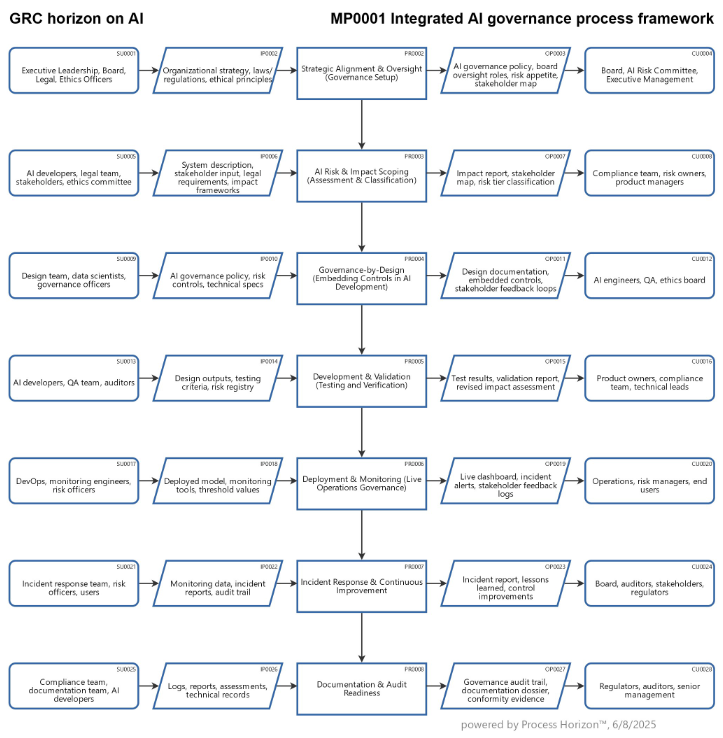

My blogs, supported by comprehensive end-to-end SIPOC process maps, advocate for a participatory, stakeholder-oriented AI modeling approach that ensures transparency, alignment, and practical relevance in banking innovation.

Below is a categorized breakdown of my past three year's blogs for banking:

1. Risk Management & Resilience

- Manage risks at a commercial bank

Scope: Enterprise-wide risk practices (credit, market, operational).

Message: Frameworks for identifying, assessing, and mitigating banking risks. - Manage VaR process at a commercial bank

Scope: Quantitative risk measurement.

Message: Implementing Value at Risk models for market exposure management. - Manage liquidity & bankruptcy risks of a commercial bank 1/2 & 2/2

Scope: Liquidity risk, solvency strategies.

Message: Techniques and stress scenarios for surviving liquidity crises. - How to manage value chain risks at Financial Institutions?

Scope: Vendor, operational, and systemic risks across financial value chains.

Message: Strategic risk mapping and mitigation in extended ecosystems. - Supervisory Stress Testing for systemically important banks

Scope: Regulatory simulations.

Message: Ensuring resilience of large banks under extreme conditions.

2. Mergers, Takeovers, and Asset Strategy

- Manage M&A Due Diligence for a big bank takeover

Scope: Legal, financial, operational due diligence.

Message: Best practices in evaluating large-scale acquisition targets. - Retail banking merger

Scope: Post-merger integration challenges.

Message: Strategic considerations in consolidating retail banking units. - Asset management process

Scope: Investment and portfolio management.

Message: Structuring, monitoring, and optimizing bank asset portfolios.

3. Regulation, Governance, and Compliance

- Promoting a safe & stable banking system through effective regulation & supervision

Scope: Macroeconomic regulatory frameworks.

Message: Role of regulation in financial system stability. - Bank rating process

Scope: Creditworthiness evaluation.

Message: How agencies and internal models assess bank ratings. - GRC perspective for the banking industry

Scope: Governance, Risk, and Compliance integration.

Message: Unified approach to policy adherence and control mechanisms. - AI empowered SOX process model for banking supervision

Scope: AI in Sarbanes-Oxley compliance.

Message: Automating internal controls testing and reporting.

4. Automation & AI in Banking

- Conceivable automation of banking processes by AI

Scope: AI-based workflow transformation.

Message: Opportunities and boundaries of AI process automation. - Real-time monitoring of transactional data for AI-driven banks

Scope: Continuous data analytics.

Message: Enhancing fraud detection, compliance, and insights via AI. - Anomaly Detection in Financial Transactions by AI ML

Scope: Machine learning for anomaly detection.

Message: Identifying irregular financial activities using ML. - Credit scoring agent

Scope: AI-based creditworthiness evaluation.

Message: How intelligent agents revolutionize scoring systems. - AI application risks in banking

Scope: Tech-related operational risks.

Message: Bias, black-box models, explainability challenges. - How to mitigate asymmetries in AI banking?

Scope: Transparency, fairness, and access in AI systems.

Message: Reducing information imbalance and ethical gaps. - Financial industry risk-return management by AI Agents

Scope: Algorithmic portfolio/risk management.

Message: Optimizing investment decisions using intelligent systems.

5. Digital Ecosystems & Transformation

- eBill: the digital invoice & payment process

Scope: Fintech integration in B2B payments.

Message: Digitizing and streamlining invoicing workflows. - Engaging a big bank's ecosystem

Scope: Partnering with fintechs, clients, regulators.

Message: Building a collaborative digital banking environment. - What data might be hidden in a bank's digital ecosystem?

Scope: Unstructured/latent data discovery.

Message: Unlocking hidden insights from overlooked data pools.

6. Process Maturity & Operational Management

- Appraise maturity of vital Banking Processes

Scope: Business process evaluation.

Message: Using maturity models to enhance banking efficiency. - How to run a bank as a going concern?

Scope: Operational sustainability.

Message: Ensuring long-term viability through sound practices.

7. Financial Innovation & Strategy

- Sustainable banking business model processes

Scope: ESG & sustainable finance.

Message: Integrating sustainability into banking operations. - Financial Engineering Horizon

Scope: Innovative financial instruments & models.

Message: Exploring the future of quantitative banking tools. - Navigating a bank's stakeholder dilemma

Scope: Balancing interests (shareholders, clients, regulators).

Message: Resolving competing priorities in strategic planning. - Opportunities & risks of a Wealth Management Robo-Advisor system

Scope: Automated investment advisory.

Message: Benefits and pitfalls of digital wealth solutions.

8. Compensation & Incentives

- Risk-adjusted compensation framework for bankers

Scope: Performance-linked pay.

Message: Aligning incentives with long-term, risk-aware behavior.