Why accounts reconciliation is vital ?

Accounts reconciliation is a process used to ensure that the financial records of an organization are accurate and in agreement. It involves comparing different sets of records to make sure they match and resolving any discrepancies. The primary purpose of accounts reconciliation is to identify, follow-up and rectify errors, discrepancies, or inconsistencies in financial records.

1. Accuracy Verification

- Reconciliation helps verify the accuracy of financial records by comparing them with external statements or records. For example, bank reconciliation involves comparing the organization's cash records with the bank statement.

2. Detection of Errors or Fraud

- Discrepancies or irregularities in financial records can be indicative of errors, omissions, or potential fraudulent activities. Reconciliation helps in the early detection of such issues.

3. Financial Reporting Integrity

- Reconciliation contributes to the overall integrity of financial reporting. Accurate financial statements are crucial for stakeholders, including investors, creditors, and regulatory authorities, to make informed decisions.

4. Cash Flow Management

- For businesses, cash flow is critical. Reconciliation of cash accounts ensures that the recorded cash transactions match actual cash movements. This is vital for effective cash flow management.

5. Compliance and Auditing

- Reconciliation is essential for compliance with accounting standards and regulations. It provides a clear audit trail and supports the organization's ability to demonstrate adherence to financial reporting requirements.

6. Identification of Bank Errors

- Bank errors, such as erroneous charges or deposits, can occur. Reconciliation helps in identifying and rectifying these errors, ensuring that the organization is not charged for transactions it did not initiate.

7. Budgeting and Planning

- Accurate financial records resulting from reconciliation are essential for effective budgeting and financial planning. Organizations rely on reliable financial data to make informed decisions about future expenditures and investments.

8. Prevention of Fraud

- Reconciliation can serve as a deterrent to fraudulent activities. Knowing that accounts are regularly reconciled and discrepancies are investigated can discourage individuals from attempting fraudulent transactions.

Accounts reconciliation is a crucial financial management practice that contributes to the accuracy, transparency and reliability of an organization's financial records.

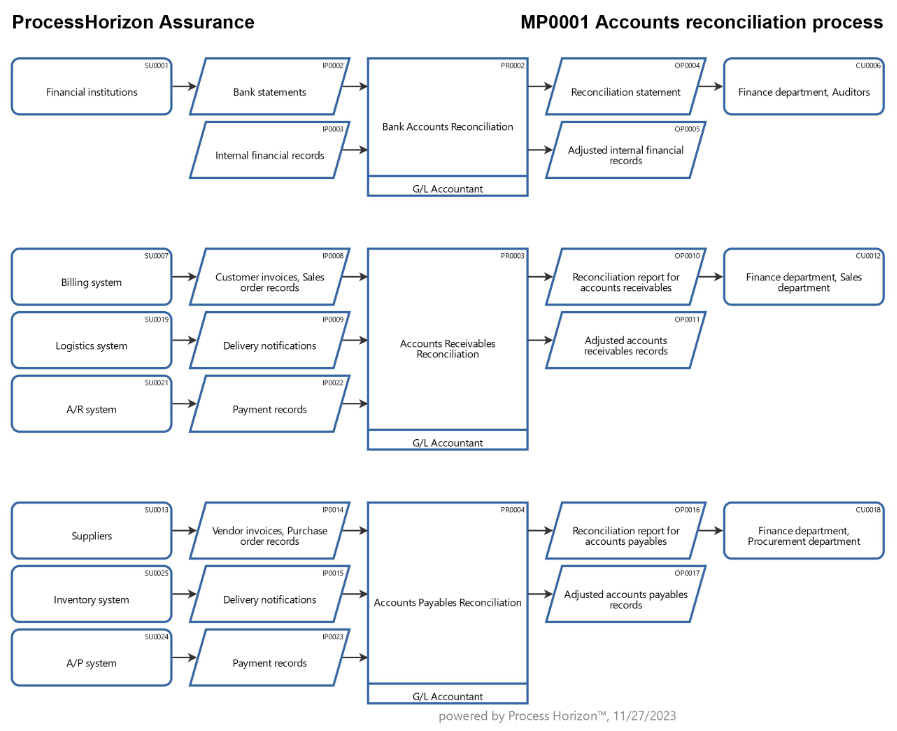

Using the following link you can access this sandbox process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automatically created visual process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/FA2CE9w4m3ZDPEnVeDF3VQDn/frontend