What data might be hidden in a bank's digital ecosystem ?

A bank's holistic digital ecosystem contains a wealth of data that, when analyzed appropriately, can reveal valuable insights into customer behavior, preferences, and overall financial trends. Here are some conceivable hidden data that could be derived from such a digital ecosystem by Triple-A systems:

1. Spending Patterns

- Identification of recurring expenses and patterns in customer spending.

- Analysis of transaction categories to understand lifestyle preferences.

2. Financial Health

- Evaluation of account balances, debt levels, and overall financial health of customers.

- Identification of customers at risk of financial distress based on transaction behavior.

3. Creditworthiness

- Assessment of creditworthiness through transaction history, loan repayment behavior, and credit utilization patterns.

- Monitoring changes in spending habits that may impact credit risk.

4. Life Events

- Detection of major life events such as weddings, births or home purchases through significant financial transactions.

- Targeted marketing based on life events to offer relevant financial products and services.

5. Customer Preferences

- Analysis of product and service usage to understand customer preferences.

- Identification of cross-selling and upselling opportunities based on historical data.

6. Fraud Detection

- Detection of unusual patterns or anomalies in transaction behavior that may indicate fraudulent activity.

- Monitoring for changes in account access patterns to identify potential security threats.

7. Geographical Trends

- Understanding regional spending habits and economic trends through location-based transaction data.

- Targeted marketing campaigns based on regional preferences.

8. Customer Segmentation

- Segmentation of customers based on demographics, spending behavior and financial goals.

- Tailoring marketing strategies and product offerings for different customer segments.

9. Product Performance

- Evaluation of the popularity and performance of various banking products and services.

- Analysis of customer feedback to improve and innovate existing offerings.

10. Digital Channel Analytics

- Tracking customer interactions across digital channels (website, mobile app, chatbots) to optimize the user experience.

- Identifying the most used channels and improving their efficiency.

11. Economic Indicators

- Aggregating and analyzing data to derive insights into broader economic trends.

- Understanding the impact of economic changes on customer behavior and banking operations.

12. Social Media Sentiment

- Monitoring social media for mentions and sentiment related to the bank.

- Addressing potential reputation management issues promptly.

13. Operational Efficiency

- Analyzing internal processes and customer interactions to identify areas for operational improvement.

- Streamlining services based on data-driven insights to enhance efficiency.

14. Cybersecurity Threats

- Analyzing data for patterns that may indicate cybersecurity threats or potential vulnerabilities.

- Enhancing security protocols based on insights from past threats and attacks.

The question is how transparent this data is to different stakeholders and what it means and how it is used by e.g. C-level management, IT experts, Auditors, Lawyers, Regulators, Bank Customers and the Public ?

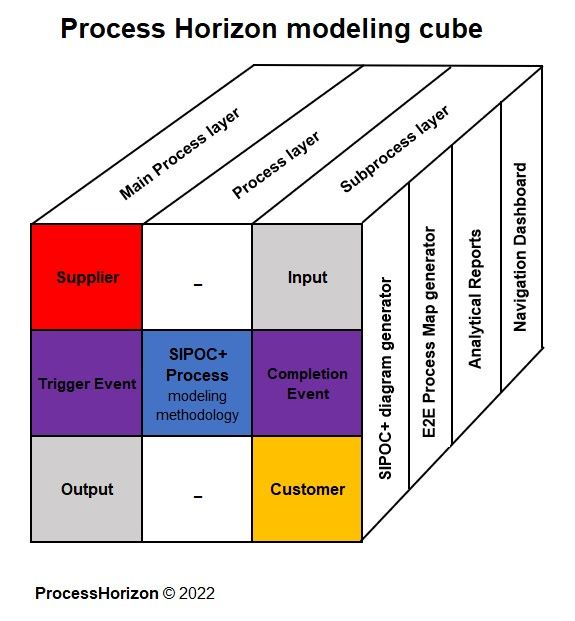

Explore the smart ProcessHorizon web app for holistic automated process & data mapping AllinONE: https://processhorizon.com