Opportunities & risks of a Wealth Managemt Robo-Advisor system

[ AI = f(Comprehensive Financial Data, Advanced Machine Learning Algorithms) + Identification of Undervalued Assets, Market Trends Analysis - Risk Assessment and Mitigation Strategies ]

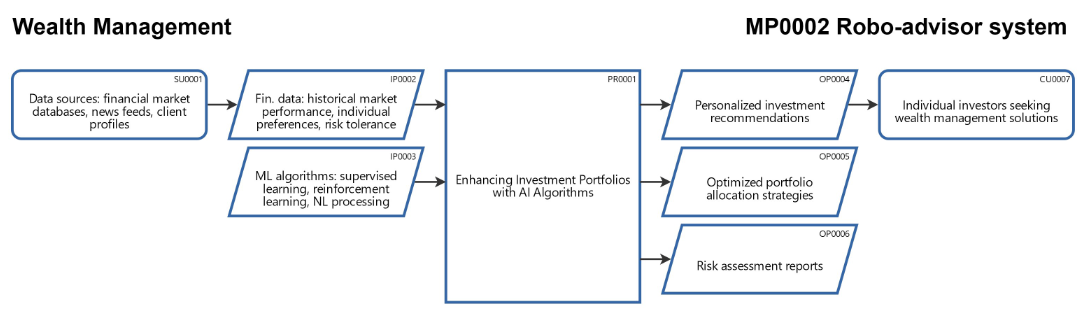

Data: The comprehensive financial data utilized in the AI wealth management project includes historical market performance, individual investment preferences, risk tolerance levels, macroeconomic indicators, real-time market updates and sentiment analysis from financial news sources. This data forms the foundation for informed decision-making and personalized investment recommendations.

Algorithms: The project employs a range of advanced machine learning algorithms, such as supervised learning for pattern recognition, reinforcement learning for decision-making and natural language processing for sentiment analysis. These algorithms enable the system to analyze complex financial data, identify patterns, optimize portfolios and generate tailored recommendations based on individual client profiles.

Opportunities & Benefits: By leveraging data-driven insights and advanced algorithms, the AI system can identify hidden investment opportunities, optimize asset allocation strategies and provide personalized wealth management solutions tailored to individual investor goals. This leads to improved portfolio performance, enhanced risk-adjusted returns and efficient decision-making processes.

Risks: Despite the benefits, there are risks associated with AI-driven wealth management, including algorithmic biases, data privacy concerns, model inaccuracies and potential market uncertainties. Effective risk assessment and mitigation strategies, such as implementing transparency measures, continuous model validation and human oversight are crucial to address these risks and ensure the system operates ethically and effectively in managing client portfolios.

The robo-advisor AI project exemplifies the formula [ AI = f(Data, Algorithms) + Opportunities - Risks ] by utilizing comprehensive financial data, advanced algorithms, identifying investment opportunities and managing risks to deliver personalized wealth management solutions for clients.

Using the following link you can access this sandbox SIPOC data & process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual AllinOne process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/Bko96NqKvvJfeAMe4xCyQbTK/frontend