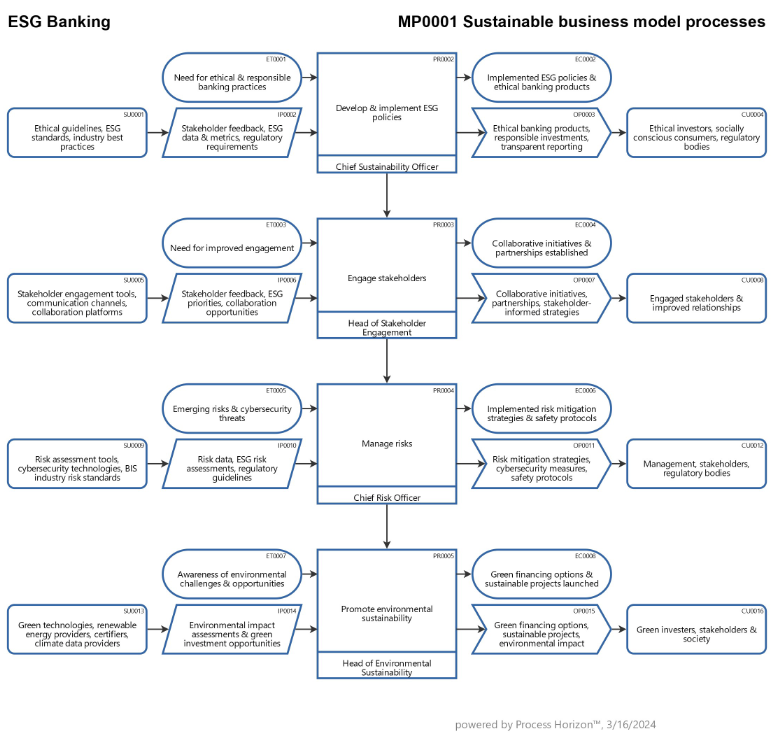

Sustainable banking business model processes

A responsible and sustainable banking strategy should be reflected in an inclusive business model and enacted by stakeholder oriented business processes.

1. Ethical Banking Practices

- Implement strict ethical guidelines for all banking activities, including lending, investments and financial products.

- Avoid investments in industries or companies that harm the environment, violate human rights or engage in unethical practices.

- Offer transparent and fair financial products and services to customers.

2. Risk Management and Safety

- Prioritize risk management to ensure the safety and stability of the bank and its stakeholders.

- Implement robust cybersecurity measures to protect customer data and financial transactions.

- Avoid speculative and high-risk investments that could jeopardize the bank's stability and reputation.

3. Stakeholder Engagement

- Actively engage with stakeholders, including customers, employees, communities and regulators to understand their needs and concerns.

- Incorporate stakeholder feedback into decision-making processes and business strategies.

- Foster a culture of trust, transparency and collaboration with all stakeholders.

4. Environmental Sustainability

- Commit to environmental sustainability by reducing the bank's carbon footprint, supporting renewable energy initiatives and promoting green investments.

- Integrate environmental risk assessments into lending and investment practices.

- Encourage sustainable practices among customers and invest in sustainable infrastructure projects.

5. Social Responsibility

- Engage in social impact initiatives, such as financial literacy programs, community development projects and support for marginalized groups.

- Promote diversity, equity and inclusion within the bank's workforce and customer base.

- Partner with NGOs and social enterprises to address social challenges and promote positive change.

6. Long-Term Value Creation

- Focus on long-term value creation rather than short-term profits.

- Align executive compensation with sustainable performance metrics, such as environmental and social impact, customer satisfaction, and employee well-being.

- Encourage responsible and sustainable consumption and investment behaviors among customers.

7. Regulatory Compliance and Governance

- Adhere to all regulatory requirements and standards, including those related to safety, risk management, environmental protection and consumer protection.

- Maintain strong governance structures with independent oversight and accountability mechanisms.

- Advocate for regulatory reforms that promote sustainable banking practices industry-wide.

8. Innovation and Technology

- Embrace innovation and technology to enhance the efficiency, accessibility and sustainability of banking services.

- Invest in fintech solutions that promote financial inclusion, improve transparency and mitigate risks.

- Leverage data analytics and AI tools for responsible decision-making and risk assessment.

Using the following link you can access this sandbox process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/yBzLXCkFnNG1WFN1XY93SEbd/frontend