Supervisory Stress Testing for systemically important banks

In addition to regular stress testing by the system relevant banks, supervisory stress testing should be triggered in case of significant events or developments in the financial markets or in the economy like a major economic downturn, financial crisis or significant change in market conditions or if there are specific concerns about the financial health of a bank or if the bank exhibits signs of increased risk.

This may prompt regulators to require immediate stress testing to assess the resilience of banks.

To prevent bank failures, several crucial controls like supervisory stress testing and regulatory measures must be implemented by financial oversight authorities.

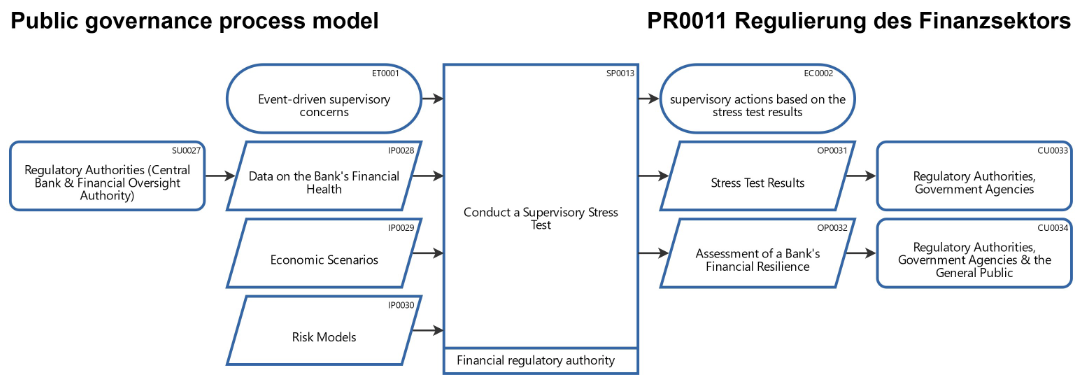

In the ProcessHorizon app, I have added this supervisory stress testing control on the subprocess level to the respective process "regulate the financial sector" which is part of the department of finance (defined as a main or key process in public administration governance).

Using the following link you can access this sandbox process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/3g1TgojZQB8SCww1bDDFDJwL/frontend