Retail banking merger

Merging two retail banks like UBS and CS can be a complex process that requires careful planning and execution. One of the biggest challenges in merging two retail banks is integrating their respective technology systems. This includes their core banking systems, data processing systems, customer relationship management (CRM) systems, and other IT systems. The banks must ensure that their systems can communicate and work together seamlessly, without any disruption to customer service.

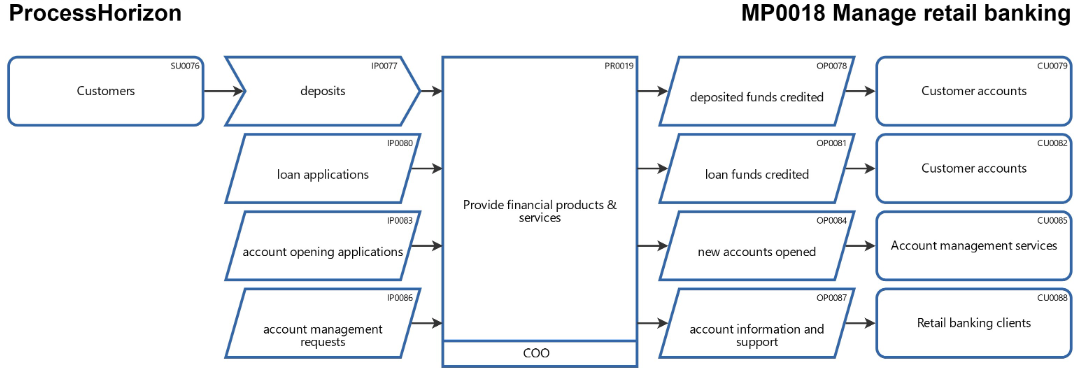

Understanding the process support of the two merging banks is vital to master the following alignment tasks: technology integration, consolidation of branches, workforce integration, regulatory compliance and customer retention. By addressing these operational problems, the banks can increase the likelihood of a successful merger and create value for their stakeholders.

Retail banking involves providing financial products and services to individuals and small businesses. This basically includes accepting deposits, providing loans, issuing credit cards, and offering other retail banking products such as savings accounts, checking accounts, and certificates of deposit.

Retail banking processes:

- Receive deposits and loan applications from customers

- Verify customer information and account details

- Process deposits and credit loan funds to customer accounts

- Open new accounts and set up account management services

- Respond to customer requests for account information and support

The ProcessHorizon web tool is a fast-track intuitive SIPOC notation based modeling tool providing instant visual process maps from your end-to-end process model input on three decomposition levels stored in a repository for standard and ad-hoc reporting.

Free trial of the smart web app https://processhorizon.com