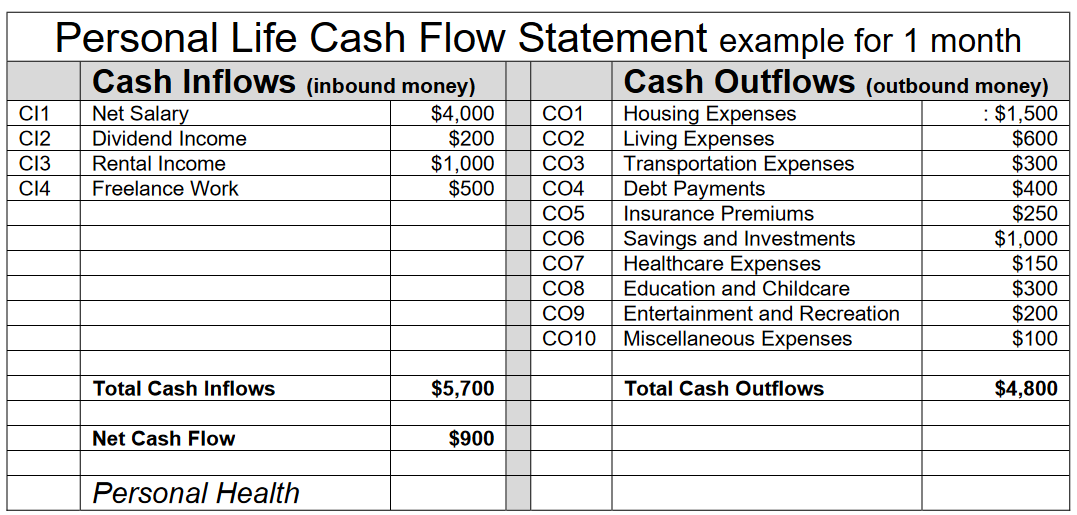

Personal Life Cash Flow Statement

A personal cash flow statement provides an overview of the cash inflows and outflows over a specific period, usually monthly or annually. It helps individuals understand how much cash is being generated and where it is being spent, aiding in budgeting and financial planning.

Cash Inflows

1. Salary and Wages

- Net salary from employment (after taxes and deductions)

- Bonuses

- Overtime pay

- Commissions

2. Investment Income

- Interest income (from savings accounts, CDs)

- Dividend income (from stocks, mutual funds)

- Capital gains (profits from the sale of investments)

3. Rental Income

- Rent received from properties owned

4. Business Income

- Net earnings from self-employment

- Profits from a side business or freelance work

5. Other Income

- Alimony or child support received

- Social Security benefits

- Pension or retirement income

- Government benefits (unemployment, disability)

- Gifts or inheritances

- Miscellaneous income (lottery winnings, royalties)

Cash Outflows

1. Housing Expenses

- Rent or mortgage payments

- Property taxes

- Home insurance

- Maintenance and repairs

- Utilities (electricity, water, gas, oil)

- Homeowners association fees

2. Living Expenses

- Groceries and household supplies

- Dining out

- Clothing and personal care

3. Transportation Expenses

- Car payments

- Auto insurance

- Fuel

- Maintenance and repairs

- Public transportation costs

4. Debt Payments

- Credit card payments

- Personal loan repayments

- Student loan payments

5. Insurance Premiums

- Health insurance

- Life insurance

- Disability insurance

- Property & Household insurance

- Car insurance

6. Savings and Investments:

- Contributions to savings accounts

- Retirement account contributions

- Investment account contributions

7. Healthcare Expenses

- Medical bills

- Prescription medications

- Health-related expenses (dental, vision)

8. Education and Childcare

- Tuition fees

- School supplies

- Childcare costs

- Extracurricular activities

9. Entertainment and Recreation

- Hobbies

- Vacations

- Subscriptions (streaming services, magazines)

10. Miscellaneous Expenses

- Gifts and donations

- Pet care

- Legal fees

By maintaining a detailed cash flow statement, individuals can gain better control over their finances, make informed decisions, and achieve financial stability.