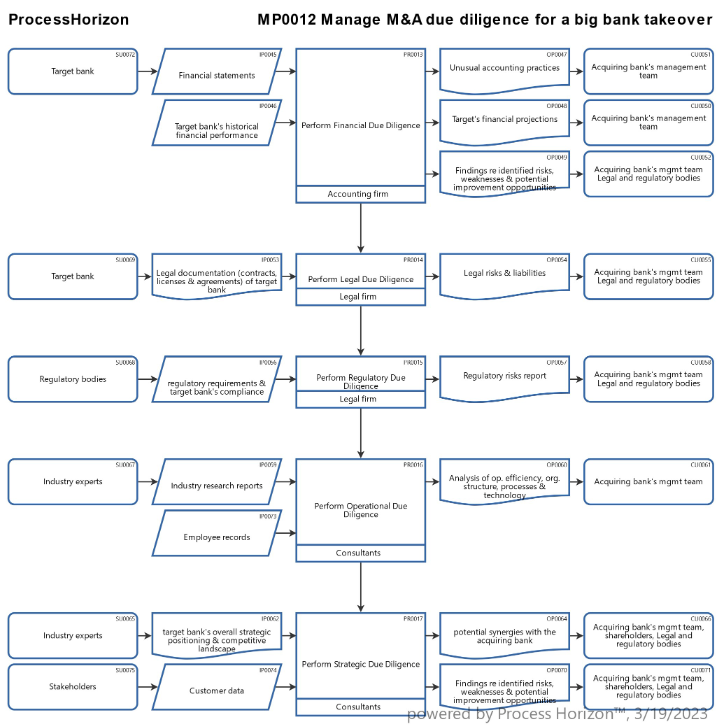

Manage M&A Due Diligence for a big bank takeover

The M&A due diligence process involves a comprehensive assessment of various areas of the target bank, including its financial health, regulatory compliance, risk management, and overall operational efficiency and overall strategic positioning. This process may involve conducting interviews with key stakeholders, reviewing historical data, and analyzing current operations.

The acquiring company is responsible for conducting due diligence on the target company to ensure that the acquisition is a sound investment and that there are no hidden liabilities or risks that could adversely affect the value of the target company.

To complement your gut feeling on conceivable M&A undertakings, I have generated a simplified M&A Due Diligence process model with an auto generated visual process map in the smart ProcessHorizon web app.

Experience the intuitive ProcessHorizon web app https://processhorizon.com on a free trial basis.