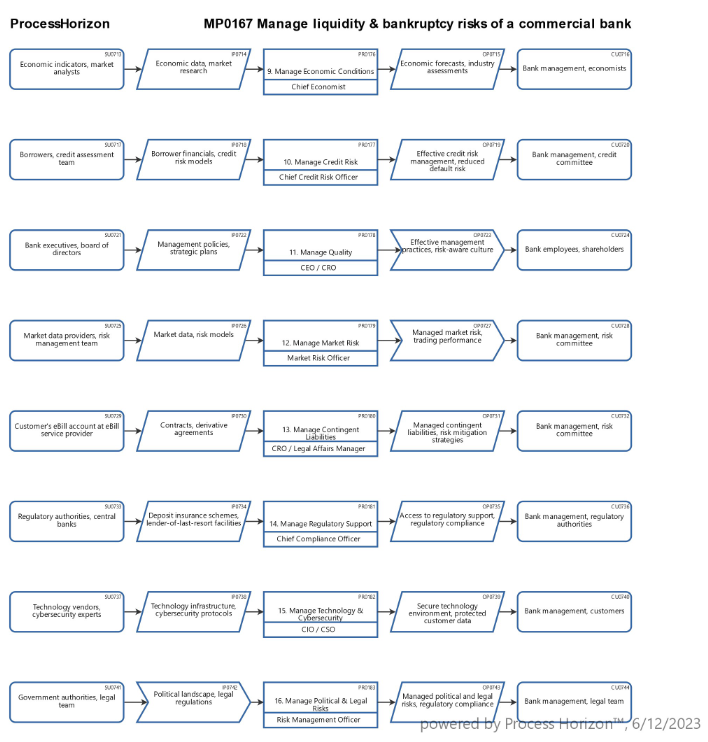

Manage liquidity & bankruptcy risks of a commercial bank 2/2

This visual SIPOC process map above illustrates the last 8 of 16 risk areas for managing the liquidity and bankruptcy risks as follows:

9. Economic Conditions: Economic analysis, scenario planning

10. Credit Risk Management: Credit underwriting, risk assessment, portfolio monitoring

11. Management Quality: Decision-making, risk governance, performance monitoring

12. Market Risk: Market risk measurement, trading limits, risk hedging

13. Contingent Liabilities: Contingent liability assessment, risk management

14. Regulatory Support: Relationship management with regulators, compliance with support programs

15. Technology and Cybersecurity: IT governance, cybersecurity risk assessment, incident response

16. Political and Legal Risks: Political risk assessment, legal compliance

My conclusion is that effective risk management by senior management and effective governance by the board of directors could have prevented the recent bank failures. Adequate oversight and rigorous appraisals by the regulatory bodies are therefore crucial.

Explore the smart ProcessHorizon web app for automated SIPOC process mapping and design: https://processhorizon.com