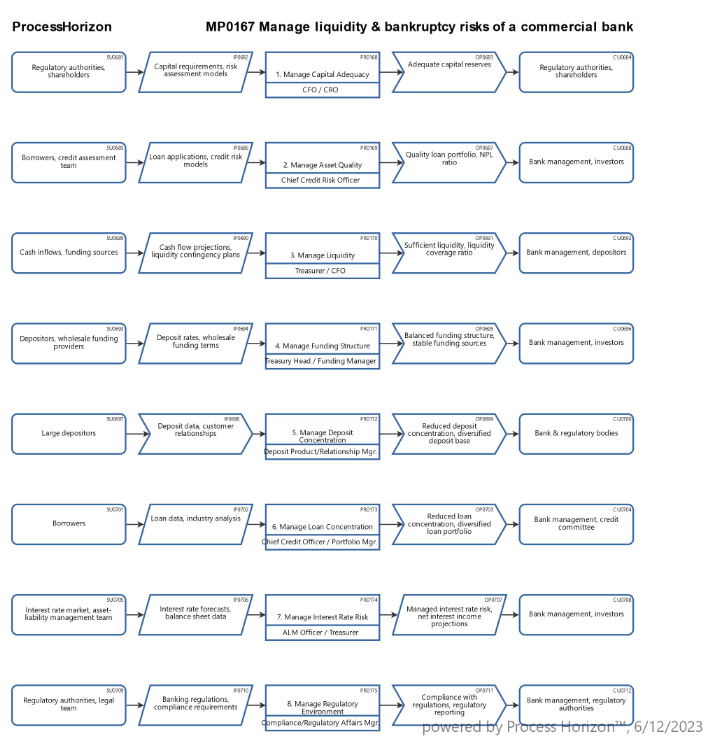

Manage liquidity & bankruptcy risks of a commercial bank 1/2

This visual SIPOC process map above illustrates the first 8 of 16 risk areas for managing the liquidity and bankruptcy risks as follows:

- Capital Adequacy: Capital planning, stress testing, risk management

- Asset Quality: Credit underwriting, loan monitoring, NPL management

- Liquidity Management: Cash management, funding strategies, liquidity stress testing

- Funding Structure: Deposit acquisition, relationship management, diversification strategies

- Deposit Concentration: Deposit monitoring, customer relationship management

- Loan Concentration: Loan portfolio analysis, risk assessment, diversification strategies

- Interest Rate Risk: Interest rate risk modeling, hedging strategies

- Regulatory Environment: Regulatory monitoring, compliance management

My conclusion is that effective risk management by senior management and effective governance by the board of directors could have prevented the recent bank failures. Adequate oversight and rigorous appraisals by the regulatory bodies are therefore crucial.

Explore the smart ProcessHorizon web app for automated SIPOC process mapping and design: https://processhorizon.com