How to mitigate asymmetries in AI banking ?

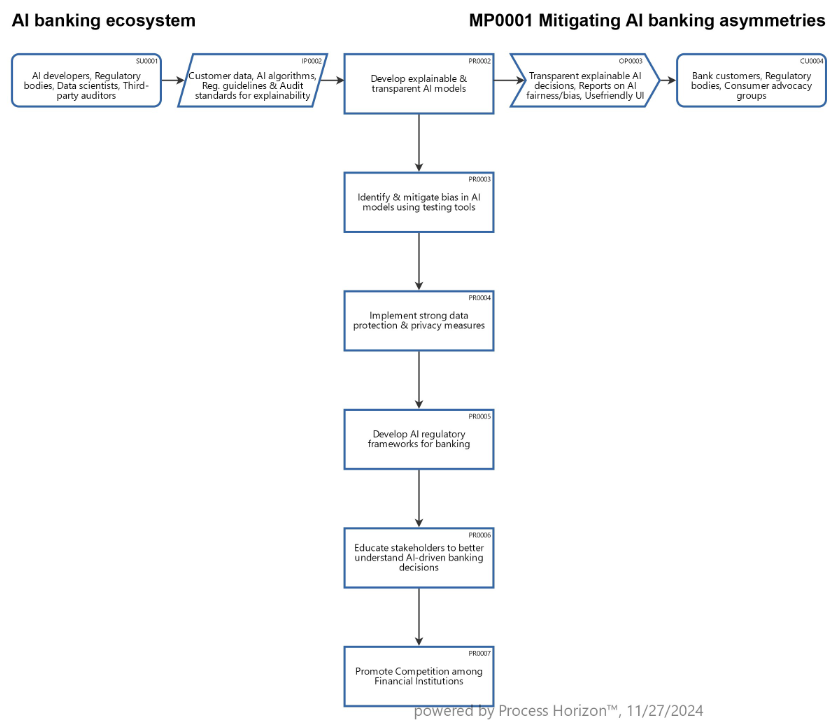

There are several ways to mitigate asymmetries in banking caused by the use of Artificial Intelligence (AI). As AI is increasingly integrated into banking systems, it introduces risks of power imbalances, where large institutions and firms with access to more data and advanced technology gain an advantage over consumers and smaller competitors. To reduce these asymmetries, banks, regulators and policymakers can adopt a variety of strategies as put forward in my SIPOC process map.

Reducing asymmetries in banking caused by AI requires a multi-faceted approach that combines transparency, bias mitigation, consumer education and regulation. By making AI systems more transparent, fair and accountable and by empowering consumers with more control over their data and decisions, it is possible to create a more balanced and equitable banking environment. Additionally, supporting competition and fostering financial literacy will further help mitigate the risks of exploitation and inequality that AI can exacerbate in the banking sector.

Using the following link you can access this sandbox SIPOC data & process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual AllinOne process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/YYjiw3TLUnBVbZoFRYc8JzUs/frontend