How can a digital agent mitigate actuarial risks ?

Actuaries play a critical role in ensuring the financial stability and reliability of insurance companies by calculating reserves, assessing risks, and guiding financial strategies. However, several potential risks arise from their work, which can impact both insurance firms and policyholders.

Potential actuarial risks to be mitigated:

1. Inaccurate Reserve Calculations

- Risk: If actuaries miscalculate insurance reserves, it can lead to inadequate funds to cover future claims, affecting the insurer’s ability to meet its obligations.

- Mitigation: Regular audits and peer reviews of reserve calculations can help ensure accuracy. Implementing stringent standards and requiring detailed documentation and justification for actuarial assumptions can also improve reliability.

2. Non-Compliance with Standards

- Risk: Actuaries may not always adhere to the regulatory standards in line with the International Association of Insurance Supervisors (IAIS), leading to discrepancies in financial reporting and risk management.

- Mitigation: Establishing a compliance monitoring system and providing continuous education and training for actuaries on the latest standards and best practices can reduce non-compliance risks.

3. Ethical Breaches

- Risk: Ethical lapses, such as conflicts of interest or manipulation of data to benefit certain parties, can undermine the trust in actuarial work and impact financial stability.

- Mitigation: Enforcing a strict code of ethics and conducting regular ethics training can help maintain high professional standards. A robust system for reporting and addressing ethical concerns is also essential.

4. Inadequate Risk Assessment

- Risk: Poor risk assessment can lead to underestimating potential liabilities, especially in scenarios like large-scale claims or unexpected events.

- Mitigation: Encouraging actuaries to use conservative assumptions and conduct stress testing can help better prepare for extreme scenarios. Regularly updating models and incorporating new data can also improve risk assessments.

5. Lack of Experience or Knowledge

- Risk: Actuaries lacking sufficient experience or specialized knowledge may make errors in complex calculations or risk evaluations.

- Mitigation: Implementing a certification and continuous education program ensures that actuaries maintain up-to-date knowledge and skills. Providing mentoring and support for less experienced actuaries can also help bridge knowledge gaps.

6. Misalignment of Interests

- Risk: Actuaries might face pressure to align their work with the interests of the insurance company rather than the policyholders.

- Mitigation: Establishing clear guidelines on professional independence and implementing checks and balances within the actuarial review process can help mitigate this risk. A well-defined conflict-of-interest policy is also crucial.

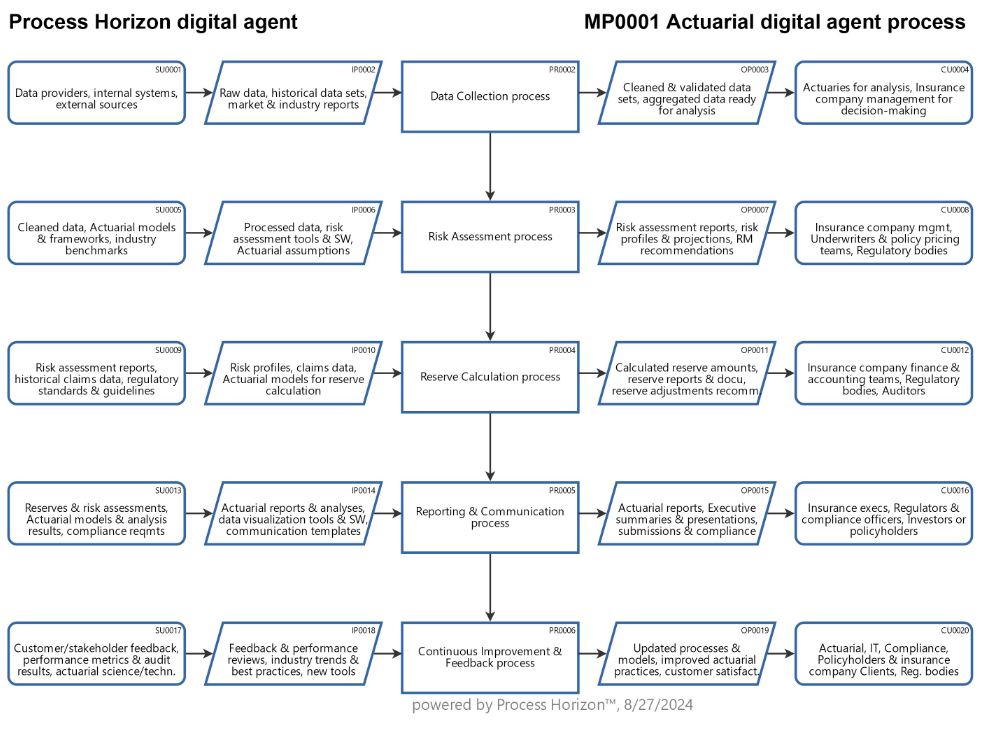

Using the following link you can access this sandbox SIPOC data & process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual AllinOne process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/J2K5x9rw5vJgdhDFD3LNivm2/frontend