Financial Engineering Horizon

Financial engineering is a multidisciplinary field that applies mathematical, statistical and computational techniques to solve problems in finance. It involves designing and implementing innovative financial instruments, strategies, and processes to achieve specific financial goals, such as managing risk, optimizing investment portfolios and enhancing returns.

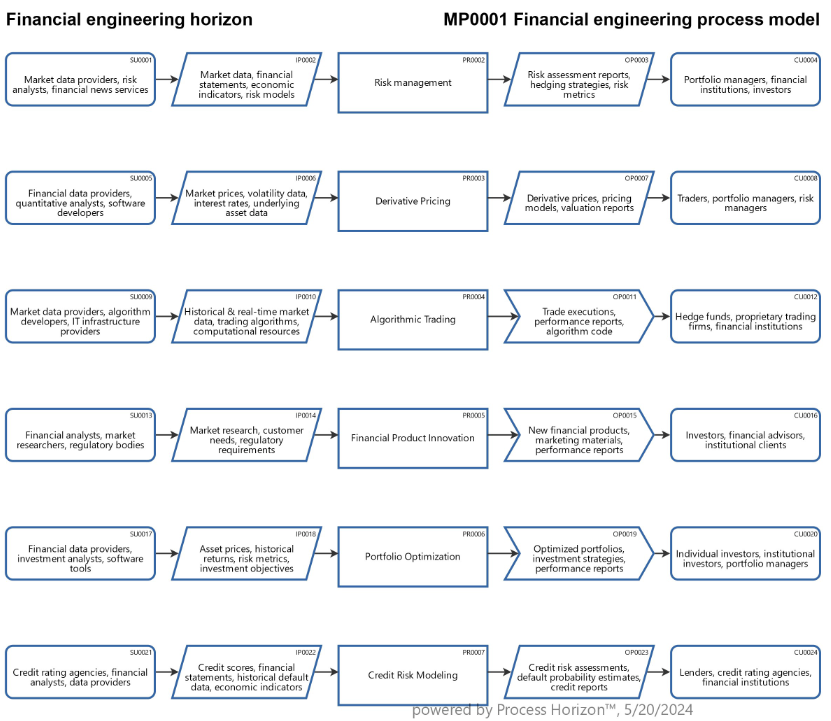

- Risk Management: Developing methods to identify, assess and mitigate financial risks. This includes creating derivative products like options, futures, and swaps to hedge against various types of risk as e.g. market risk & credit risk.

- Derivative Pricing: Designing models to determine the fair value of derivative instruments. Techniques such as the Black-Scholes model, Monte Carlo simulation and binomial trees are commonly used.

- Algorithmic Trading: Creating automated trading strategies that use quantitative models to make trading decisions. These strategies can execute trades at high speed and volume, often exploiting minute price discrepancies in the market.

- Financial Products Innovation: Engineering new financial products to meet the needs of investors and institutions. This can include structured products, exotic options and other complex instruments tailored to specific risk-return profiles.

- Portfolio Optimization: Using quantitative methods to construct portfolios that maximize return for a given level of risk or minimize risk for a given level of expected return. Techniques such as mean-variance optimization and factor models are employed.

- Credit Risk Modeling: Developing models to assess the creditworthiness of borrowers and the risk of default. This involves statistical techniques to estimate the probability of default and potential loss given default.

Financial engineering, while offering significant benefits through innovation and optimization, also presents various risks to stakeholders such as Investors, Financial Institutions, Employees, Regulators, Corporations as well as to the Economy & Society.

Failures of financial engineering models as attributed to the LTCM hedge fund collapse, the 2008 financial crisis, the Enron and the Archegos Capital Management scandals can happen again due to a lack of understanding by the bank's board members, the regulators as well as the investors of the financial engineering algorithms further augmented by the use of AI.

Using the following link you can access this sandbox process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/X25Yz8tYgjrh1CQYLgoczGud/frontend