Evaluating Investments in Sustainable Companies

Warren Buffett’s investment strategy, often referred to as value investing, revolves around several core principles. Based on information in the book "Warren Buffett and the Interpretation of Financial Statements" by Mary Buffett and David Clark, the essence of Warren Buffett’s approach can be distilled into the following key concepts:

1. Intrinsic Value vs. Market Price

- Intrinsic Value: Buffett emphasizes investing in companies whose intrinsic value (the true worth based on fundamentals) is higher than their current market price. This intrinsic value is determined through comprehensive analysis of a company's financial health, business model and future cash flows.

- Margin of Safety: He seeks a margin of safety, which means buying stocks at a significant discount to their intrinsic value to minimize risk and increase the likelihood of achieving a positive return.

2. Focus on Quality Businesses

- Economic Moat: Buffett prefers businesses with a sustainable competitive advantage or "economic moat," which helps them maintain profitability and fend off competitors over the long term. This could be due to strong brand, unique products or cost advantages.

- Consistent Earnings: He looks for companies with a consistent record of earnings and profitability, indicating stability and reliable performance.

3. Long-Term Investment Horizon

- Buy and Hold: Buffett’s strategy involves buying high-quality companies and holding them for the long term. He believes in investing in businesses that he would be comfortable owning indefinitely, reflecting a focus on long-term growth rather than short-term market fluctuations.

4. Management Quality

- Trustworthy & capable Management: The quality of the company’s management is crucial. Buffett invests in companies led by competent, honest and shareholder-friendly management teams.

5. Understanding the Business

- Circle of Competence: Buffett only invests in businesses that he thoroughly understands. This "circle of competence" ensures that he can accurately assess the risks and potential of the investment.

6. Financial Health and Value

- Strong Financials: He values companies with strong balance sheets, healthy cash flows, and good returns on equity. Low levels of debt and high profitability are indicators of financial health.

- Attractive Valuation: Even if a company is strong, Buffett will only invest if it is reasonably priced compared to its intrinsic value. He avoids overpaying for investments.

7. Economic and Market Independence

- Ignore Market Noise: Buffett advises focusing on the intrinsic value of businesses rather than being swayed by short-term market trends or external economic conditions.

8. Ethical Considerations

Principled Investing: Ethical considerations and corporate governance are important to Buffett. He prefers companies that operate with integrity and have a positive impact on society.

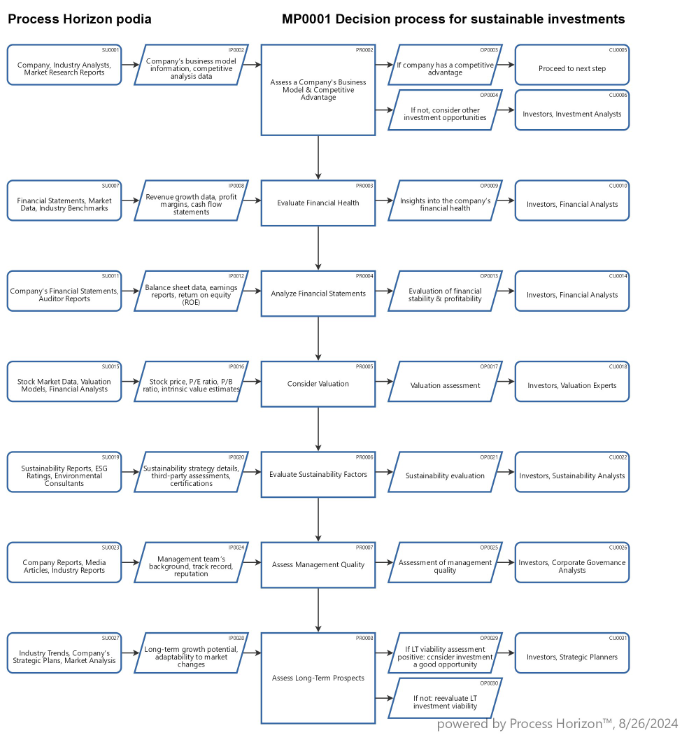

Using the following link you can access this sandbox SIPOC data & process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual AllinOne process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/6jo7yftQa8VfPh6EMB3UtW8u/frontend