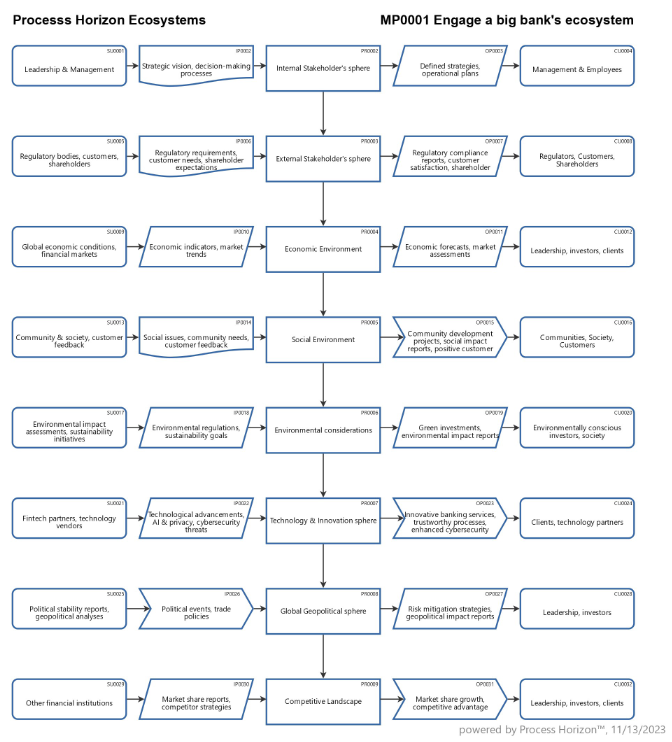

Engaging a big bank's ecosystem

Mapping the ecosystem of a big international bank involves understanding its interactions with various stakeholders, the broader economic and regulatory environment as well as the social and environmental impacts of its operations governed by responsible and sustainable business practices.

1. Internal Stakeholder's sphere

- Leadership and Management: The top executives, board of directors, and senior management shape the bank's strategies and decision-making.

- Employees: The bank's workforce, from front-line staff to back-office support, plays a crucial role in daily operations and customer service.

2. External Stakeholder's sphere

- Customers: Individuals, businesses, and institutional clients who use the bank's financial services for banking, investment and wealth management.

- Shareholders: Individuals and institutional investors who own shares and expect returns on their investments.

- Regulators: Regulatory bodies such as financial authorities and central banks that oversee and regulate the bank's operations to ensure compliance with laws and regulations.

3. Economic Environment

- Global Economy: A bank is influenced by the overall economic conditions, including interest rates, inflation and global market trends.

- Financial Markets: A bank operates in various financial markets, including equities, fixed income and foreign exchange and is affected by market fluctuations.

4. Social Environment

- Community and Society: A bank has social responsibilities to the communities in which it operates, including philanthropy, community development and social impact initiatives.

- Customer Relations: Building and maintaining positive relationships with customers is vital for the bank's reputation and success.

5. Environmental considerations

- Environmental Impact: The bank may be involved in sustainable finance and responsible investment, considering the environmental impact of its investments and operations.

- Carbon Footprint: The bank may have initiatives to reduce its carbon footprint and adopt environmentally friendly practices.

6. Technology and Innovation

- Fintech Partnerships: Collaboration with financial technology companies for innovation in banking services and digital transformation.

- Responsible and trustworthy AI: Process reengineering e.g. by RPA

- Cybersecurity: Protecting customer data and ensuring the security of digital transactions is critical in the modern banking ecosystem.

7. Global Geopolitical sphere

- Political Stability: The bank is affected by geopolitical events and changes in political stability that can impact the global economy.

- Trade Policies: Changes in international trade policies and regulations can affect the bank's cross-border operations.

8. Competitive Landscape

- Other Financial Institutions: Competing with other international banks and financial institutions for market share and clients.

Using the following link you can access this sandbox process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automatically created visual ecosystem map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/qkahPx6LywFcTeLSh9WKuqpV/frontend