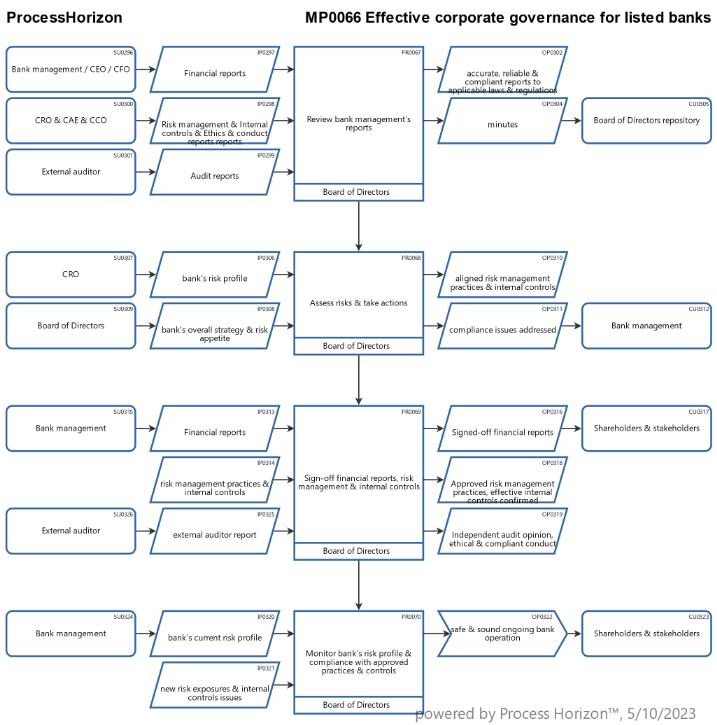

Effective corporate governance for listed banks

Effective corporate governance rules for the banking industry, including for too big to fail banks' board of directors, should be designed to promote transparency, accountability, and sound risk management practices. Here are some examples of rules that could be put in place for financial reports, risk management, and internal controls:

- Financial Reports: The board of directors should be responsible for reviewing and signing off on the bank's financial reports, including its balance sheet, income statement, and cash flow statement. The board should ensure that the reports are accurate, reliable, and in compliance with accounting standards.

- Risk Management: The board of directors should be responsible for overseeing the bank's risk management practices, including its credit risk, market risk, and operational risk. The board should ensure that the bank has appropriate risk management policies and procedures in place, and that these policies are being followed. The board should also regularly review the bank's risk profile and ensure that it is aligned with the bank's overall strategy and risk appetite.

- Internal Controls: The board of directors should be responsible for ensuring that the bank has adequate internal controls in place to manage its risks effectively. This includes controls over financial reporting, operations, and compliance. The board should also regularly review the effectiveness of the bank's internal controls and make improvements as necessary.

- Audit: The board of directors should oversee the bank's internal audit function and external auditors. The board should ensure that the internal audit function has sufficient resources and independence to carry out its responsibilities effectively. The board should also ensure that the external auditors are providing independent and objective assessments of the bank's financial statements and internal controls.

- Ethics and Conduct: The board of directors should establish a code of conduct and ethics for the bank and ensure that it is being followed. The board should also ensure that the bank has appropriate policies and procedures in place to manage conflicts of interest and prevent insider trading.

Overall, effective corporate governance rules for the banking industry, and specifically for too big to fail banks, should prioritize transparency, accountability, and sound risk management practices. By ensuring that these rules are followed, the board of directors can help ensure that the bank is operating in a safe and sound manner, and that it is serving the best interests of all stakeholders.

Explore the versatility of the smart ProcessHorizon web app https://processhorizon.com