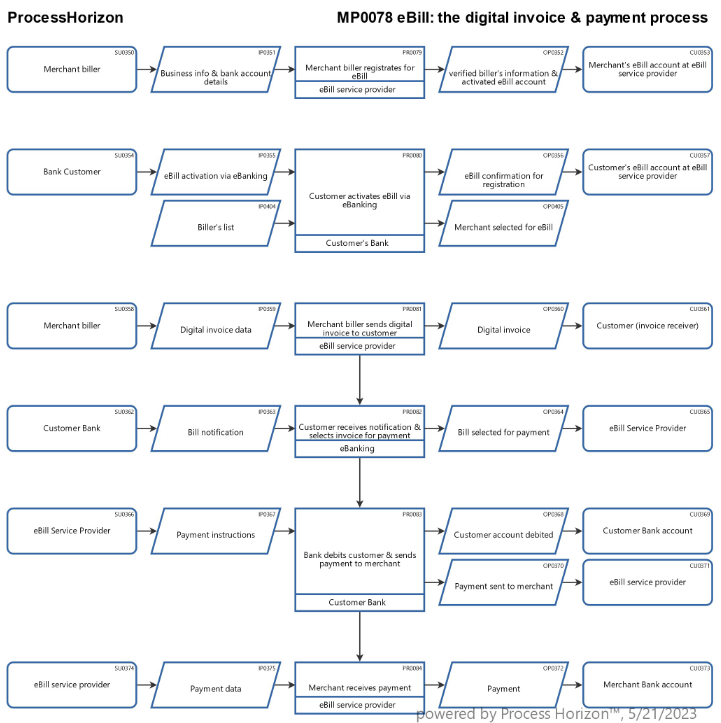

eBill: the digital invoice & payment process

eBill is a service from SIX and the infrastructure is operated by SIX on behalf of the Swiss banks. At the time being, there are about 4'000 merchant billers and over 2.7 million registered users or eBill customers.

There are several benefits of the digital eBill invoice for payments in Switzerland:

- Convenience: With eBill, customers no longer need to manually enter payment details or visit the merchant's website to pay a bill. They can simply log in to their eBanking account and pay the bill with just a few clicks.

- Efficiency: eBill streamlines the payment process for both customers and merchants, reducing the time and effort required for bill processing and payment. This can result in faster payment processing and improved cash flow for merchants.

- Accuracy: eBill eliminates the possibility of errors that can occur during manual payment entry, reducing the need for correction and potential disputes.

- Security: eBill transactions are encrypted and sent directly between the customer's bank and the merchant's bank, ensuring a secure payment process.

- Cost savings: eBill reduces costs associated with paper-based billing and payment processing, such as printing, postage, and manual data entry.

- Environmental impact: eBill eliminates the need for paper bills and reduces the environmental impact of paper waste and energy consumption associated with traditional billing and payment processes.

- Data privacy & security: What are the implications of the new Swiss Data Protection act to become effective on September 1, 2023 for the eBill Service Provider, the merchant billers and the Swiss banks ?

Overall, eBill provides a convenient, efficient, secure, and environmentally friendly way for customers and merchants to process bill payments, while reducing costs and potential errors.

Explore the smart ProcessHorizon web app for automated process modeling with auto generation of visual end-to-end process maps: