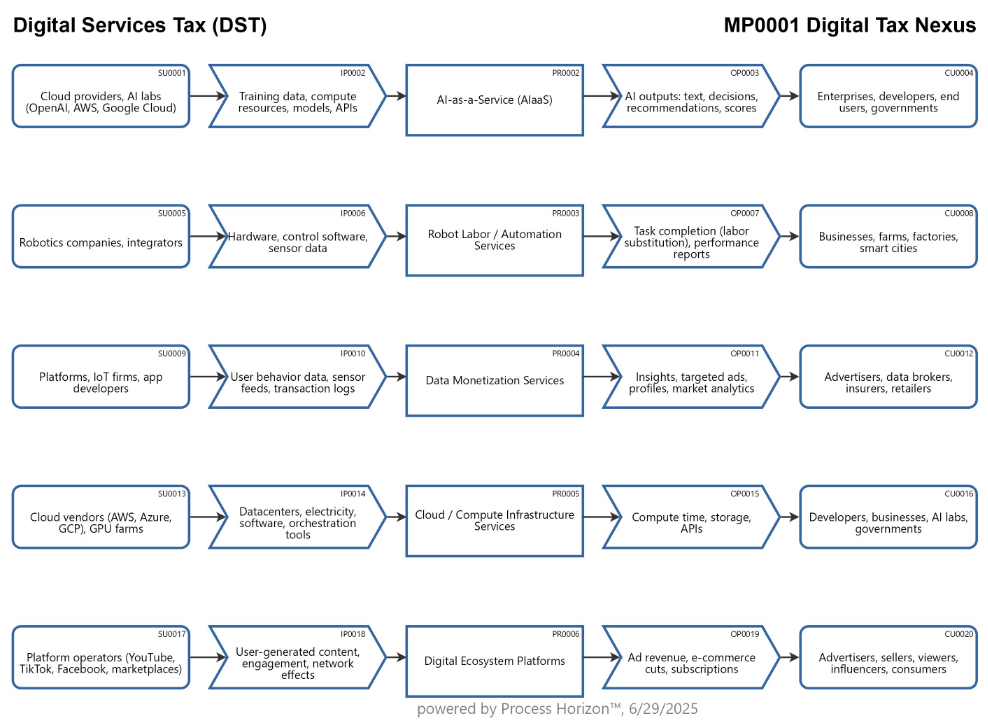

Digital Services Tax nexus

In the AI age the digital value chain isn't produced by labor or land, but by data, code, and compute. Taxation must evolve to meet that, perhaps through an updated OECD initiative or a new global compact.

New Digital Services Tax (DST) nexus principles

To make this work, the traditional permanent establishment (PE) rule would be replaced by a digital presence or virtual nexus, defined by:

- User base or engagement level in a country.

- Volume of data collected from users/devices in that jurisdiction.

- Compute intensity or automated task completion (robotics, AI inference).

- Revenue thresholds tied to digital footprint, not offices.

This is location-agnostic but user-centric, i.e. the tax nexus is wherever value is created from digital interaction or automation, not where the company is headquartered.

1. AI-as-a-Service (AIaaS): Deliver AI services via API or app interface (e.g. chatbots, analysis tools)

> Charge DST on revenue earned from users in a jurisdiction using AI APIs or services.

2. Robot Labor / Automation Services: Deploy robot systems to perform tasks (e.g. cleaning, harvesting, delivery)

> Tax robot-performed services that replace human labor in the local economy (robot labor tax).

3. Data Monetization Services: Collect, process, and sell/analyze data

> Impose DST based on monetized data originating from citizens/devices in-country.

4. Cloud / Compute Infrastructure Services: Rent compute (VMs, GPUs, storage) to run apps, models, workloads

> Tax compute sold to users in the jurisdiction (similar to utility tax), especially for high-intensity AI/ML jobs.

5. Digital Ecosystem Platforms: Host & curate content, facilitate ads/sales, monetize attention

> Apply DST to revenue earned from in-country users, ad impressions, and platform sales.

Using the following link you can access this sandbox SIPOC model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual AllinOne SIPOC map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/Q2MrwHs28gsEsVEx5PgFyoFJ/frontend