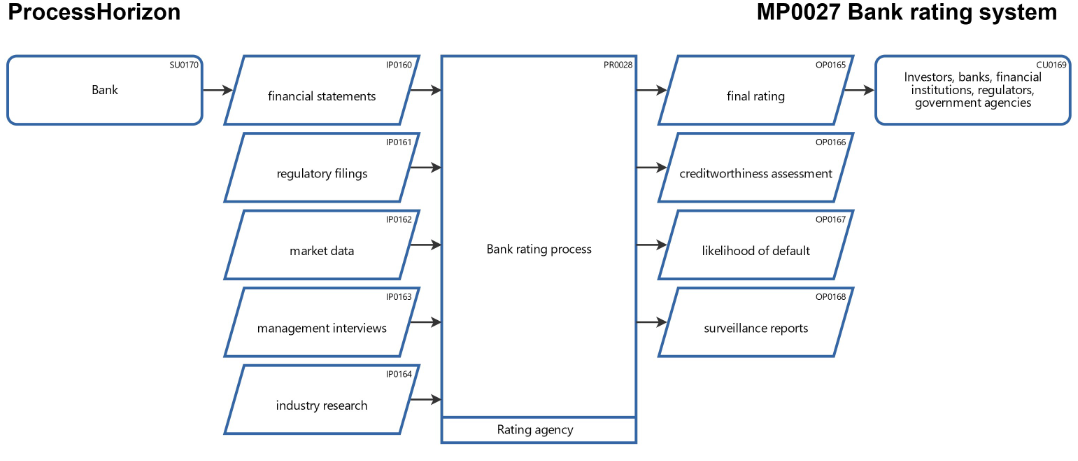

Bank rating process

The bank rating process involves several steps as follows:

- a pre-rating analysis to determine the key factors that will influence the bank's rating,

- an initial rating assessment,

- an in-depth analysis of the bank's financial condition,

- management interviews to gain a deeper understanding of the bank's business model and risk management practices,

- a review and final rating assignment, and

- ongoing surveillance to ensure that the rating remains accurate and up-to-date.

What might be missing also considering capital adequacy, asset quality, management, earnings, liquidity and sensitivity (CAMELS) used by regulatory banking authorities ?

Explore the smart ProcessHorizon web app https://processhorizon.com for better process designs of your making.