Appraise maturity of vital Banking Processes

Understanding of a bank's processes by the board of directors, senior management and staff is vital for effective management towards continuity. Bank processes should thus be well documented and be implemented across the organization to ensure that standardized best practice operational processes are followed in all business activities.

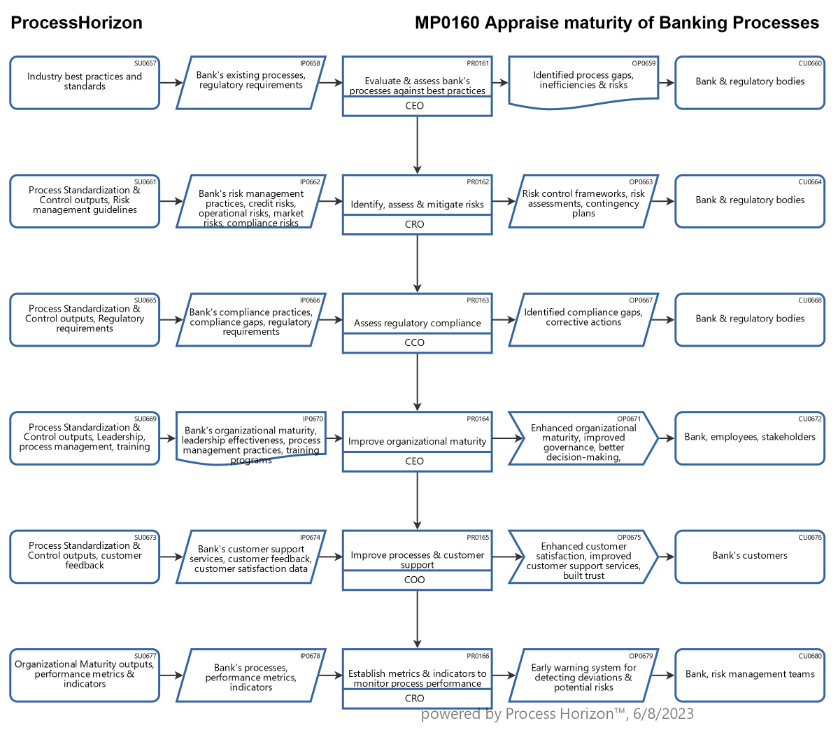

Vital banking processes for sustainable risk mitigation as set forth in my SIPOC process map should be appraised by regulatory bodies on an ongoing data-driven basis and if found under par be put under special regulatory watch.

- Process Standardization and Control: The process maturity appraisal should evaluate and assesse the bank's processes against industry best practices and standards. By identifying process gaps, inefficiencies, and risks, the bank can implement standardized processesprocess maturity that are robust, controlled, and aligned with regulatory requirements. This helps reduce operational errors and minimizes the risk of non-compliance, which can contribute to bank failure.

- Risk Identification and Mitigation: Process maturity appraisals emphasize risk management and provide guidelines for identifying, assessing, and mitigating risks. Through the appraisal process, the bank can strengthen its risk management practices, including the identification of credit risks, operational risks, market risks, and compliance risks. This enables the bank to proactively implement risk mitigation measures, such as establishing risk control frameworks, conducting risk assessments, and developing contingency plans.

- Compliance Adherence: Regulatory compliance is a critical factor in the stability and survival of banks. Process maturity appraisals assess the bank's compliance with industry standards and regulatory requirements. By identifying compliance gaps and weaknesses, the bank can take corrective actions to ensure adherence to regulations and avoid penalties or legal issues that could lead to bank failure.

- Organizational Maturity: Process maturity appraisals focus on improving organizational maturity, which includes factors such as leadership, process management, training, and continuous improvement. A higher level of organizational maturity reduces the likelihood of failure by promoting effective governance, better decision-making, employee competence, and a culture of learning and adaptability.

- Customer Satisfaction and Trust: The process maturity appraisal process also considers customer satisfaction as an important aspect of organizational maturity. By improving processes and customer support services, the bank can enhance customer experience, build trust, and foster long-term relationships. Satisfied customers are more likely to continue their business with the bank, reducing the risk of customer attrition that could impact the bank's stability and reputation.

- Early Warning System: Through the process maturity appraisal process, the bank can establish metrics and indicators to monitor the performance and effectiveness of its processes. This creates an early warning system that can detect deviations, anomalies, or signs of potential risks. By proactively addressing these issues, the bank can prevent them from escalating into major problems that could lead to bank failure.

Overall, process maturity appraisals for a bank could significantly contribute to risk mitigation by enhancing operational processes, strengthening risk management practices, ensuring compliance, improving organizational maturity, and prioritizing customer satisfaction. By identifying and addressing potential risks, the bank can increase its resilience and decrease the likelihood of failure, thereby safeguarding its stability and reputation in the market.

Explore the smart ProcessHorizon web app for automated process mapping and design of end-to-end process models > https://processhorizon.com