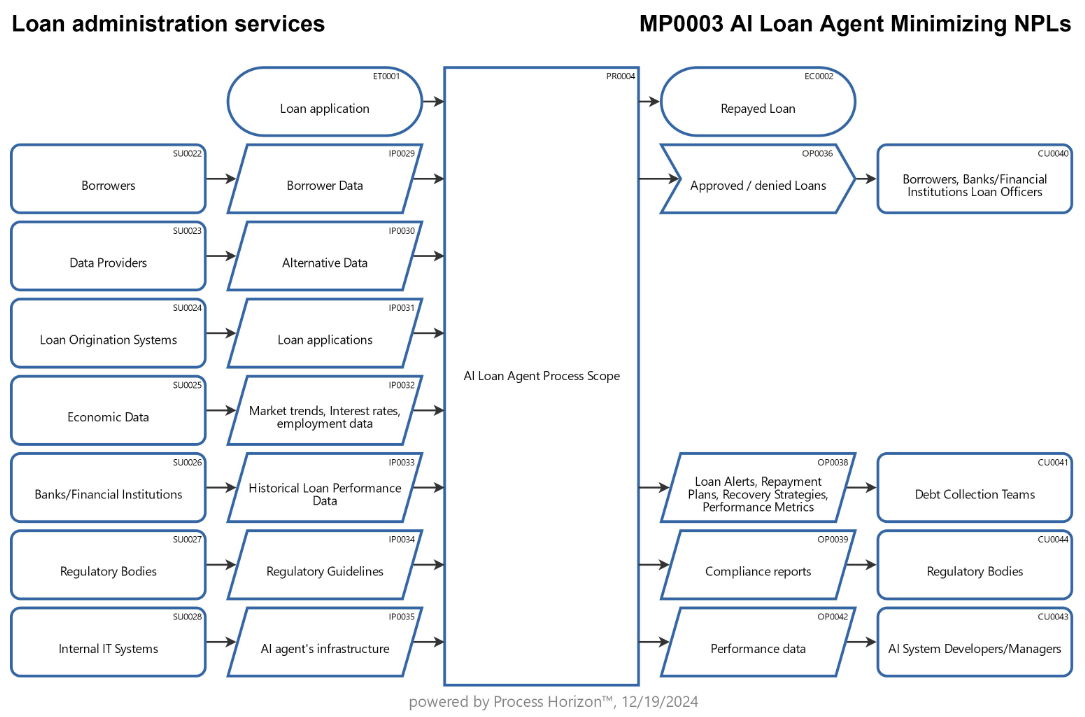

AI Loan Agent Minimizing NPLs

Minimizing non-performing loans (NPLs) using an effective AI-powered loan agent can be achieved through several strategies. These strategies revolve around leveraging AI's ability to process large amounts of data, predict future borrower behavior and take proactive measures to manage loan performance.

- Enhanced Credit Scoring and Risk Assessment

- Early Warning Systems

- Personalized Loan Management

- Predictive Analytics for Loan Recovery

- Automating Loan Restructuring

- Fraud Detection and Prevention

- Optimizing Loan Origination Processes

- AI-Driven Customer Insights

- Improved Collection Strategies

- Continuous Learning and Improvement

By implementing an AI-powered loan agent, financial institutions can significantly reduce the risk of non-performing loans. AI can automate many aspects of the lending process, from more accurate risk assessments to better loan recovery strategies, while also improving communication with borrowers. These systems can help identify and address potential defaults before they escalate, making the lending process more efficient and less risky for both lenders and borrowers.

Using the following link you can access this sandbox SIPOC data & process model in the ProcessHorizon web app and adapt it to your needs (easy customizing) and export or print the automagically created visual AllinOne process map as a PDF document or share it with your peers: https://app.processhorizon.com/enterprises/5SiH2dvJW4Vzmr7Un8rzVMPt/frontend