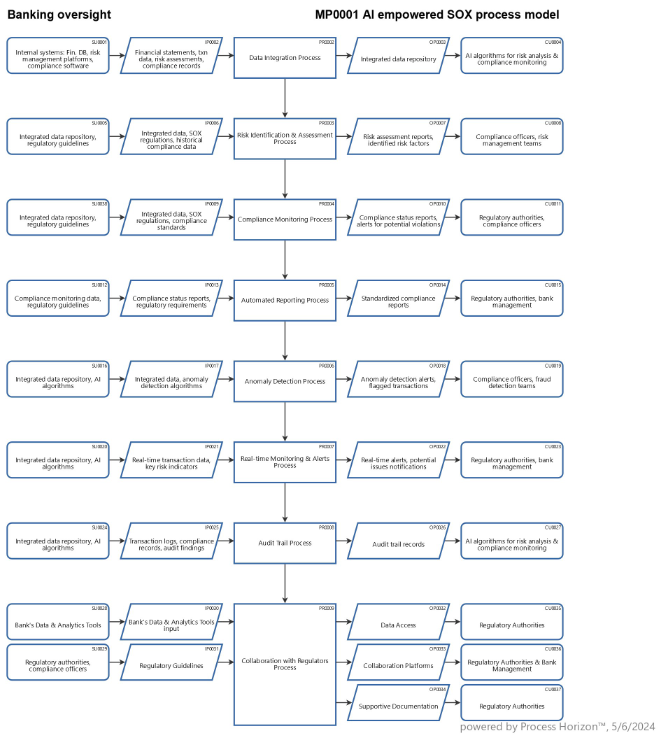

AI empowered SOX process model for banking supervision

Providing regulators with dynamic access to relevant data and analytics tools to support their oversight activities in an AI-driven financial services universe can offer material benefits and cost savings to banks and regulatory bodies.

Benefits & cost savings to Financial Institutions

- Enhanced Regulatory Compliance: By providing regulators with access to relevant data and analytics tools, financial institutions can demonstrate their commitment to regulatory compliance. This can help build trust and credibility with regulatory authorities, potentially reducing the likelihood of regulatory scrutiny or enforcement actions.

- Improved Efficiency: Collaborating with regulators and providing them with access to data can streamline regulatory inquiries and examinations. Regulators can directly access the necessary information they need for oversight activities, reducing the burden on banks to respond to ad-hoc requests or onsite examinations.

- Proactive Risk Management: Regulators may provide valuable insights and feedback on banks' risk management practices based on their analysis of the provided data. This can help banks identify potential risks and weaknesses in their operations early on, allowing them to take proactive measures to mitigate risks and enhance resilience.

- Foster Innovation: Collaboration with regulators can create an environment conducive to innovation. By sharing data and insights with regulators, banks can engage in constructive dialogue on emerging trends, technologies and best practices. This can facilitate the adoption of innovative solutions while ensuring compliance with regulatory requirements.

- Strengthened Reputation: Demonstrating transparency and cooperation with regulators can enhance a bank's reputation in the industry and among customers. It signals a commitment to ethical conduct and regulatory compliance which can improve stakeholder trust and loyalty.

Benefits & cost savings to Regulatory Bodies

- Increased Effectiveness: Access to comprehensive data and analytics tools empowers regulatory bodies to conduct more effective oversight activities. They can perform deeper analyses of financial institutions' operations, identify potential risks more accurately and take timely actions to address emerging threats to financial stability.

- Better Informed Decision-Making: Access to timely and relevant data enables regulators to make better-informed decisions. They can use data-driven insights to assess the overall health of the financial system, identify systemic risks and formulate appropriate regulatory policies and interventions.

- Enhanced Supervisory Efficiency: Direct access to banks' data and analytics tools streamlines the supervisory process for regulators. They can conduct off-site monitoring and analysis, reducing the need for extensive on-site examinations and minimizing disruptions to banks' operations.

- Early Warning of Problems: By monitoring banks' data in real-time, regulators can receive early warnings of potential problems or irregularities. This allows them to intervene promptly to address issues before they escalate into systemic crises, thereby safeguarding financial stability.

- Promote Market Integrity and Consumer Protection: Access to data and analytics tools enables regulators to detect and prevent market abuses, fraud, and misconduct. This helps uphold market integrity and protects consumers from unfair practices, fostering confidence in the financial system.

Overall, providing regulators with access to relevant data and analytics tools promotes transparency, collaboration and effectiveness in regulatory oversight, benefiting both financial institutions and regulatory bodies while contributing to the stability and integrity of the financial system.